The middle-market lending landscape is witnessing a surge in specialized healthcare financing, with Wingspire Capital providing a $35 million senior secured revolving credit facility to Advita Ortho, a global orthopedic solutions provider that emerged from the restructuring of Exactech. The transaction, announced January 12, 2026, underscores the growing appetite among alternative lenders to support companies navigating complex turnarounds in the medical device sector.

Advita Ortho represents a phoenix rising from the ashes of one of the orthopedic industry's most challenging bankruptcies. The company acquired a comprehensive portfolio of established product lines—including the Equinoxe® Shoulder, Vantage® Ankle, Alteon® Hip, and Truliant® Knee systems—along with a team of experienced employees, surgeons, and innovators during the restructuring of Exactech. The financing will support general corporate purposes as Advita expands sales across its product portfolio and distribution agreements.

A Healthcare Finance Platform Takes Shape

The Advita transaction marks a significant milestone for Wingspire Capital's healthcare-focused lending strategy. The deal demonstrates the growth and demand for Wingspire Capital's Healthcare Finance platform, which was established last year to address the unique capital needs of middle-market healthcare companies. The platform offers a comprehensive suite of financing solutions, including asset-oriented revolvers, first-out revolvers, and term loans—all tailored to the healthcare sector's distinctive requirements.

"Wingspire Capital is pleased to provide a flexible capital solution that helps Advita accelerate its position as a leader in orthopedic implants and surgical navigation technology," said Mark Klaassens, Managing Director at Wingspire Capital, in a statement.

The timing of Wingspire's healthcare platform launch appears prescient. As healthcare companies face mounting pressure from regulatory scrutiny, product liability concerns, and shifting reimbursement dynamics, the need for specialized lenders who understand sector-specific risks has intensified. Wingspire's approach—offering one-stop solutions of up to $200 million for middle market companies—positions the firm to capture deals that traditional banks may find too complex or risky.

Wingspire Capital operates as a portfolio company of Blue Owl Capital Corporation (NYSE: OBDC), which is externally managed by Blue Owl Credit Advisors LLC. The backing of Blue Owl Capital, Inc., a global alternative asset manager with $295.6 billion of assets under management as of September 30, 2025, provides Wingspire with substantial firepower to pursue middle-market opportunities across multiple sectors.

From Bankruptcy to New Beginning: The Exactech Story

To understand Advita Ortho's significance, one must first grasp the tumultuous journey of its predecessor. Exactech, once a respected player in the orthopedic device market, faced a perfect storm of challenges that ultimately led to its downfall. Having spent $20 million on recalls and litigation between October 2023 and October 2024, Exactech filed for Chapter 11 protection owing $352 million.

The company's troubles stemmed from widespread product recalls related to polyethylene defects in its implants, which triggered thousands of lawsuits from patients experiencing device failures. In July 2024, a special committee formed by Exactech began evaluating possible restructuring options, including bankruptcy, and by October 2024, the company had entered into a comprehensive restructuring process.

The restructuring attracted a consortium of sophisticated distressed investors. Advita's ownership group includes affiliates of Strategic Value Partners, Stellex Capital Management, and Greywolf Capital Management. These firms saw value in Exactech's core product portfolio and intellectual property, despite the litigation overhang. Strategic Value Partners, with $22 billion in assets under management and $53 billion invested, brought deep experience in complex restructurings to the transaction.

The investor group entered into a comprehensive restructuring support agreement and asset purchase agreement, serving as the stalking horse bidder to acquire substantially all of Exactech's assets. They provided approximately $85 million of additional financing to fund the company's operations through the restructuring process, ensuring continuity of operations and maintaining relationships with surgeons and healthcare systems.

A Comprehensive Product Portfolio

Advita Ortho inherited a diverse and clinically proven product portfolio spanning multiple joint categories. Advita now owns and distributes established lines like the Equinoxe Shoulder, Vantage Ankle, Alteon Hip, Truliant Knee, Newton balancing technology, and GPS® navigation systems. The company also distributes products including the Spartan Hip and Triverse® Knee lines, providing comprehensive coverage across major orthopedic segments.

Joint Category | Product Line | Description |

|---|---|---|

Shoulder | Equinoxe® | Comprehensive shoulder arthroplasty platform featuring anatomic and reverse configurations with innovative baseplate designs for initial and biologic fixation |

Ankle | Vantage® | Semi-constrained total ankle replacement system for end-stage arthritis, featuring patient-specific instrumentation and anatomically-focused biomechanics |

Hip - Owned | Alteon® | Platform hip system with cementless femoral stems, including hydroxyapatite-coated options and revision monobloc configurations |

Hip - Distributed | Spartan | Total hip arthroplasty system optimized for minimally invasive anterior approach with customizable offset and leg length positioning |

Knee - Owned | Truliant® | Total knee system with anatomically-designed implants, proprietary net compression molded polyethylene inserts, and streamlined instrumentation for multiple surgical approaches |

Knee - Distributed | Triverse® | Primary knee replacement system with anterior and posterior stabilized constructs, featuring highly crosslinked vitamin E polyethylene and streamlined instrumentation |

Surgical Technology - Balancing | Newton® | Ligament-driven knee balancing technology providing real-time soft tissue assessment and mediolateral gap balance optimization during total knee procedures |

Surgical Technology - Navigation | GPS® | Computer-assisted surgical navigation system delivering high-accuracy resections within 1mm for optimal alignment in joint replacement procedures |

The product portfolio's breadth gives Advita significant competitive advantages. The company can offer surgeons a complete suite of solutions across shoulder, hip, knee, and ankle procedures—a one-stop-shop approach that simplifies procurement and builds loyalty among orthopedic practices. The inclusion of advanced surgical technologies like Newton balancing technology, which has shown remarkable ability to achieve mediolateral gap balance more effectively than conventional techniques, and GPS navigation, which delivers planned resections with high accuracy within 1mm, differentiates Advita from competitors focused solely on implants.

The Truliant Knee system exemplifies the portfolio's quality. It features net compression molded polyethylene inserts with excellent wear resistance and streamlined instrumentation for alternative surgical approaches, addressing surgeons' needs for both clinical performance and procedural flexibility. Similarly, the Equinoxe Shoulder system's baseplates feature anatomic shape with six screw hole options and innovative bone cage for initial and biologic fixation, demonstrating the engineering sophistication embedded in these product lines.

Riding a Wave of Market Growth

Advita Ortho enters the market at an opportune moment. The global orthopedic implants industry is experiencing robust growth driven by demographic trends, technological innovation, and expanding access to joint replacement procedures.

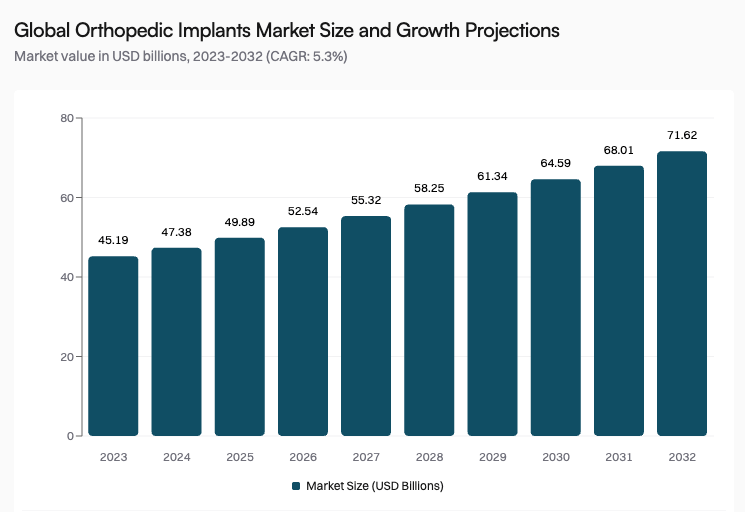

The market's trajectory reflects powerful underlying fundamentals. The global orthopedic implants market size was valued at $45.19 billion in 2023 and is anticipated to grow to $71.74 billion by 2032, exhibiting a CAGR of 5.3% during the forecast period. This represents nearly 60% growth over nine years, creating substantial opportunities for well-positioned competitors.

Several factors drive this expansion. The aging global population faces increasing rates of osteoarthritis, osteoporosis, and other musculoskeletal conditions requiring surgical intervention. According to the International Osteoporosis Foundation, about 8.9 million fractures occur due to osteoporosis each year globally, creating sustained demand for trauma and joint reconstruction implants.

Technological advancements are also expanding the addressable market. Minimally invasive surgical techniques, robotic-assisted procedures, and patient-specific implants are making joint replacement accessible to younger, more active patients who previously would have delayed surgery. The shift toward outpatient and ambulatory surgery center procedures is reducing costs and improving patient convenience, further accelerating adoption.

North America dominated the orthopedic implants market with a market share of 55.59% in 2023, with the region accounting for $25.12 billion in market value. The U.S. market alone is projected to reach an estimated value of $35.57 billion by 2032, driven by favorable reimbursement policies, high rates of musculoskeletal disorders, and a sophisticated healthcare infrastructure.

The Middle-Market Lending Opportunity

Wingspire Capital's financing of Advita Ortho illustrates a broader trend in middle-market lending: the rise of specialized, sector-focused credit platforms that can underwrite complex situations traditional banks avoid. Healthcare companies, particularly those in medical devices, present unique underwriting challenges that require deep industry expertise.

The healthcare sector demands lenders who understand regulatory pathways, reimbursement dynamics, clinical evidence requirements, and product liability risks. Wingspire's dedicated healthcare finance platform signals its commitment to building this expertise in-house, rather than treating healthcare as just another industry vertical.

For companies like Advita Ortho—emerging from bankruptcy with strong assets but complicated histories—access to flexible capital is essential. The $35 million senior secured revolving credit facility provides working capital to fund inventory, support sales and marketing efforts, and invest in product development. Revolving facilities offer particular value to medical device companies with lumpy cash flows tied to surgical procedure volumes and hospital purchasing cycles.

Wingspire's structure as a portfolio company of Blue Owl Capital Corporation provides strategic advantages. Blue Owl's scale—$295.6 billion of assets under management—enables Wingspire to offer larger facilities and more competitive terms than standalone middle-market lenders. The relationship also provides access to Blue Owl's broader network of portfolio companies, potentially creating commercial synergies and cross-selling opportunities.

Challenges and Opportunities Ahead

While Advita Ortho's prospects appear promising, the company faces significant challenges as it seeks to establish itself in a highly competitive market. The orthopedic device industry is dominated by large, well-capitalized players including Stryker, Zimmer Biomet, Johnson & Johnson's DePuy Synthes, and Smith+Nephew. These companies possess extensive sales forces, established surgeon relationships, and substantial R&D budgets that enable continuous innovation.

Advita must also navigate the legacy of Exactech's product recalls and litigation. While the restructuring process aimed to address these liabilities, the company will need to rebuild trust with surgeons, hospitals, and patients who may harbor concerns about product quality and reliability. Transparency about quality control improvements, enhanced post-market surveillance, and robust clinical data will be essential to overcoming this reputational hurdle.

The company's ownership by distressed debt investors also raises questions about long-term strategic direction. Will the private equity sponsors pursue organic growth, invest in R&D and sales expansion, and build Advita into a sustainable competitor? Or will they focus on financial engineering, cost-cutting, and a relatively quick exit through sale to a strategic buyer? The answer will significantly impact Advita's trajectory and its ability to capitalize on the growing orthopedic market.

On the positive side, Advita benefits from acquiring proven products with established clinical track records at what was likely a significant discount to their intrinsic value. The company inherited not just intellectual property and inventory, but also a team of experienced employees, surgeons, and innovators who understand the products and maintain relationships with key opinion leaders in orthopedic surgery.

The company's comprehensive product portfolio—spanning shoulder, hip, knee, ankle, and surgical technology—provides cross-selling opportunities and positions Advita as a full-service partner to orthopedic practices. Smaller competitors often focus on a single joint category, limiting their relevance to surgeons who perform multiple procedure types.

Implications for Healthcare Finance

The Wingspire-Advita transaction offers insights into the evolving healthcare finance landscape. As healthcare companies face increasing complexity—from regulatory pressures to reimbursement challenges to product liability risks—the need for specialized lenders with sector expertise intensifies.

Traditional commercial banks have largely retreated from middle-market healthcare lending, particularly for companies with any hint of distress or complexity. This creates opportunities for alternative lenders like Wingspire to step into the void, offering flexible capital solutions at attractive risk-adjusted returns.

The establishment of dedicated healthcare finance platforms by middle-market lenders reflects recognition that healthcare requires specialized underwriting capabilities. Understanding FDA regulatory pathways, CMS reimbursement policies, clinical trial design, and healthcare M&A dynamics demands expertise that generalist lenders typically lack.

For healthcare companies, the proliferation of specialized lenders expands financing options and potentially improves terms. Competition among lenders focused on the same sector should drive more favorable pricing, covenant flexibility, and creative deal structures. Companies like Advita Ortho benefit from having multiple potential financing sources rather than being dependent on a single relationship bank.

The transaction also highlights the role of distressed investing in healthcare. Sophisticated investors like Strategic Value Partners, Stellex Capital, and Greywolf Capital saw value in Exactech's assets despite the bankruptcy and litigation challenges. Their willingness to provide approximately $85 million of additional financing through the restructuring, followed by Wingspire's $35 million revolving facility, demonstrates that capital remains available for healthcare companies with strong underlying assets, even when facing significant headwinds.

Looking Forward

Advita Ortho's success will depend on execution across multiple dimensions: rebuilding surgeon confidence, expanding market share, investing in product innovation, and managing the financial obligations that come with leveraged ownership. The company must prove that it can overcome Exactech's troubled legacy and establish itself as a credible competitor in the orthopedic device market.

For Wingspire Capital, the Advita transaction represents a proof point for its healthcare finance platform. Successfully supporting Advita's growth will validate the platform's strategy and potentially attract additional healthcare borrowers seeking specialized lenders who understand their industry's unique dynamics.

The broader orthopedic device market's projected growth to $71.74 billion by 2032 provides a favorable backdrop for both companies. As the market expands, there should be room for multiple competitors to succeed, particularly those offering differentiated products, strong clinical evidence, and responsive customer service.

The Wingspire-Advita deal ultimately reflects several converging trends: the rise of specialized middle-market lending, the opportunities in distressed healthcare assets, and the sustained growth of the orthopedic device market. Whether this particular transaction succeeds will depend on execution, but the underlying dynamics suggest that similar deals will continue to emerge as alternative lenders seek opportunities in complex healthcare situations.