Warburg Pincus has successfully closed its third dedicated financial services fund at $3.0 billion, surpassing its initial $2.5 billion target, the New York-based private equity giant announced this week. The oversubscribed fundraise marks the firm's largest sector-specific financial services vehicle to date and underscores sustained institutional investor confidence in specialized strategies even as broader private equity fundraising faces headwinds.

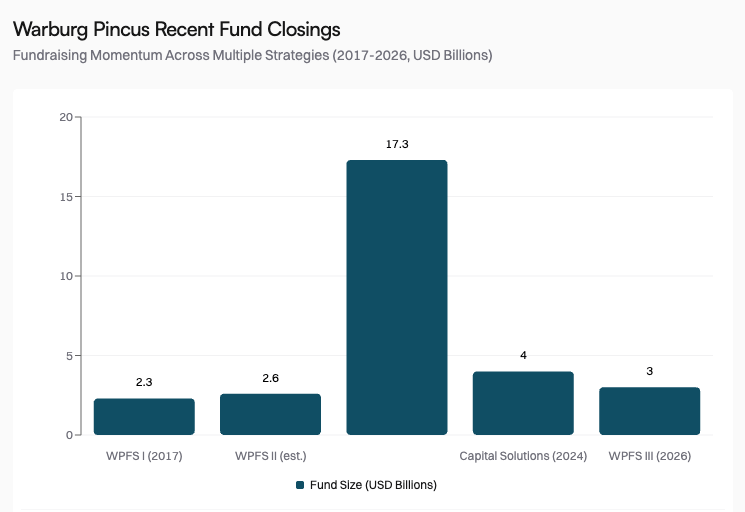

The fund, formally known as Warburg Pincus Financial Sector III (WPFS III), represents a 20% increase over its predecessor and caps a remarkable fundraising run for the 60-year-old firm. Coming on the heels of its $17.3 billion Global Growth 14 flagship fund in 2023 and a $4 billion capital solutions fund in 2024, the latest close demonstrates Warburg Pincus's ability to attract capital across multiple strategies simultaneously—a feat that has eluded many competitors in today's selective fundraising environment.

A Five-Decade Commitment to Financial Services

The successful close of WPFS III reflects more than just market timing. It validates a strategic thesis that Warburg Pincus has been refining since the 1970s: that financial services represents one of the most durable and opportunity-rich sectors for growth-oriented private equity investment.

Over five decades, Warburg Pincus has deployed nearly $27 billion across over 160 financial services companies, establishing what may be the industry's most comprehensive track record in the sector. This isn't opportunistic capital allocation—it's systematic sector expertise built through multiple market cycles, from the savings and loan crisis of the 1980s through the 2008 financial crisis and into today's fintech-driven transformation.

Metric | Insurance | Banking | Fintech & Payments | Specialty Finance | Overall Track Record |

|---|---|---|---|---|---|

Key Portfolio Companies | ParetoHealth, multiple carriers | IDFC FIRST Bank, Techcombank, Self Bank | Ant Group, Mynt, Matera, Network International, Payjoy, Varo, Clearwater Analytics | LendingPoint, Edelman Financial Engines | 160+ companies, $27B deployed, 5 decades |

Investment Examples | Strategic growth investments | $877M (IDFC FIRST), $370M+ (Techcombank) | $300M+ (Mynt), $100M (Matera) | $125M (LendingPoint) | WPFS III: $3.0B (exceeded $2.5B target) |

Geographic Focus | North America | Asia (India, Vietnam), Europe (Spain) | Asia (Philippines, China), Latin America (Brazil), North America | North America, Global | Leading Asia investor, global presence |

Sector Characteristics | Carriers, MGAs, health insurance platforms | 18 regulated institutions, digital banking, emerging markets | Digital wallets, payment processing, financial infrastructure | Consumer lending, wealth management, asset management | Full spectrum coverage |

The firm's portfolio spans the full spectrum of financial services subsectors. In insurance, it has backed carriers and brokers across property & casualty, life, and specialty lines. In banking, Warburg Pincus has invested in 18 regulated banking institutions globally, including major positions like $877 million in India's IDFC FIRST Bank and over $370 million in Vietnam's Techcombank.

But it's in fintech and payments where the firm's forward-looking strategy becomes most apparent. Portfolio companies include Ant Group, Clearwater Analytics, Edelman Financial Engines, Network International, Payjoy, and Varo, alongside emerging market champions like Mynt (Philippines' GCash), which raised over $300 million at a $2 billion valuation, and Brazil's Matera, which secured $100 million to expand its banking software platform.

Strategic Rationale: Why Financial Services Now?

The timing of WPFS III's close is particularly noteworthy given the macroeconomic backdrop. As Warburg Pincus CEO Jeff Perlman noted, the fundraising success came despite a "complex macroeconomic and geopolitical backdrop"—a diplomatic reference to elevated interest rates, persistent inflation concerns, and geopolitical tensions that have dampened risk appetite across asset classes.

Yet several structural trends make financial services an attractive hunting ground for private equity capital right now.

Digital transformation acceleration: The pandemic permanently shifted consumer and business behavior toward digital channels, creating massive opportunities for technology-enabled financial services providers. Traditional institutions need capital and expertise to modernize legacy systems, while digital-native challengers require growth capital to scale. Warburg Pincus sits at the intersection of both trends.

Emerging market financial inclusion: In developing economies across Asia, Latin America, and Africa, hundreds of millions of consumers are accessing formal financial services for the first time. This secular growth trend—driven by smartphone penetration and regulatory reforms—creates decades-long investment runways. Warburg Pincus's position as one of the largest private equity investors in financial services in Asia positions it to capitalize on this megatrend.

Regulatory clarity improving: After years of post-2008 regulatory uncertainty, many jurisdictions have established clearer frameworks for fintech innovation, digital banking, and cross-border payments. This regulatory maturation makes financial services investments more predictable and attractive to institutional capital.

Valuation normalization: The 2021-2022 fintech bubble has deflated, bringing valuations back to levels that support attractive risk-adjusted returns. For a disciplined investor like Warburg Pincus, this creates a target-rich environment.

Fundraising Momentum Across Strategies

WPFS III's success is part of a broader pattern of fundraising strength at Warburg Pincus. The firm has now raised over $24 billion across three major vehicles in just three years—a remarkable achievement that places it among the most successful fundraisers in the industry.

The Global Growth 14 fund, which closed at $17.3 billion, also exceeded its initial $16 billion target, demonstrating LP appetite for Warburg Pincus's diversified growth equity strategy. The $4 billion capital solutions fund, meanwhile, reflects the firm's expansion into alternative credit and structured capital—a growing segment as traditional lenders retreat from certain markets.

This multi-strategy approach provides several advantages. It allows Warburg Pincus to pursue opportunities across the capital structure and risk spectrum, from minority growth investments to control buyouts to credit solutions. It also diversifies the firm's revenue streams and reduces dependence on any single fundraising cycle.

Importantly, the firm has maintained discipline on fund sizing. While some mega-cap peers have raised $20+ billion flagship funds that strain deployment capacity, Warburg Pincus has kept its vehicles at levels that allow for selective, high-conviction investing. The $3 billion size of WPFS III, for instance, suggests a portfolio of 15-25 companies at typical check sizes of $100-300 million—a manageable scope that allows for deep partnership with management teams.

Competitive Positioning in a Crowded Field

Warburg Pincus faces no shortage of competition in financial services investing. Firms like KKR, Carlyle, Bain Capital, and TPG all maintain active financial services practices. Specialist firms like Aquiline Capital Partners and Centerbridge Partners focus exclusively on the sector.

What differentiates Warburg Pincus is the combination of scale, geographic reach, and operational expertise. The firm's over 160 financial services investments provide a network effect—each new portfolio company can benefit from insights, introductions, and best practices gleaned from dozens of prior investments. This institutional knowledge is particularly valuable in navigating complex regulatory environments and executing technology transformations.

The firm's global footprint—with offices across North America, Europe, Asia, and Latin America—allows it to source deals locally while providing portfolio companies with international expansion support. This matters enormously in financial services, where local market knowledge and regulatory relationships are critical success factors.

Deployment Strategy and Investment Themes

While Warburg Pincus hasn't disclosed specific deployment plans for WPFS III, the firm's recent investment activity provides clues to likely focus areas.

Specialty finance and alternative lending: Investments like LendingPoint's $125 million preferred equity round suggest continued interest in non-bank lenders serving underserved segments. As traditional banks face capital constraints and regulatory burdens, specialty finance companies are capturing market share in consumer lending, small business finance, and niche verticals.

Banking infrastructure and software: The $100 million investment in Matera, a Brazilian banking software provider, exemplifies the "picks and shovel" strategy of investing in technology platforms that enable financial institutions rather than competing with them directly. This approach offers attractive risk-adjusted returns with less regulatory complexity than investing in banks themselves.

Payments and transaction processing: The firm's portfolio includes multiple payments companies across geographies, reflecting the massive secular shift from cash to digital payments. With global payment volumes growing at high single-digit rates annually, this remains a high-conviction theme.

Insurance technology and distribution: While less publicized than fintech, insurance represents a $6 trillion global market ripe for technology-driven disruption. Warburg Pincus's insurance investments span carriers, managing general agents, brokers, and technology platforms.

Emerging market financial institutions: The firm's willingness to invest in regulated banks in markets like India, Vietnam, and the Philippines—where many Western investors fear to tread—provides access to some of the world's fastest-growing financial services markets with less competition for deals.

LP Composition and Investor Rationale

The limited partners who committed capital to WPFS III represent a who's who of institutional investors, though Warburg Pincus hasn't disclosed specific names. Based on the firm's historical LP base, the fund likely includes major public pension funds, sovereign wealth funds, insurance companies, endowments, foundations, and family offices.

What attracts these sophisticated investors to a sector-focused fund in an era when many LPs are reducing manager relationships and consolidating capital with generalist mega-funds?

First, track record matters. Warburg Pincus's five-decade history in financial services provides performance data across multiple cycles—a critical consideration for institutional investors with long time horizons. While specific fund returns aren't public, the firm's ability to raise successively larger financial services funds suggests strong historical performance.

Second, specialization creates competitive advantages. In an increasingly efficient market, generalist funds struggle to source proprietary deals and add operational value. Sector specialists like Warburg Pincus can leverage deep industry relationships, technical expertise, and pattern recognition from dozens of prior investments to generate alpha.

Third, the financial services sector offers attractive risk-return characteristics for institutional portfolios. Unlike venture capital or growth equity in technology, where binary outcomes are common, financial services investments typically offer more predictable cash flows, lower technology risk, and clearer paths to profitability. This makes them suitable for LPs seeking private equity exposure with somewhat lower volatility.

Challenges and Risks Ahead

Despite the successful fundraise, WPFS III faces significant deployment challenges in the years ahead.

Valuation discipline in competitive markets: With multiple well-capitalized firms pursuing financial services deals, maintaining valuation discipline will be critical. The temptation to deploy capital quickly in a competitive environment can lead to overpaying for assets—a particular risk given the fund's oversubscription.

Regulatory uncertainty: While regulatory frameworks have stabilized in many markets, financial services remains one of the most heavily regulated sectors globally. Changes in capital requirements, consumer protection rules, or cross-border data flows could materially impact portfolio company economics.

Technology disruption risk: The same digital transformation creating opportunities also poses risks. Incumbent financial institutions face existential threats from digital-native challengers, while fintech companies must navigate rapidly evolving technology stacks and changing consumer preferences. Picking winners in a fast-moving landscape requires both conviction and humility.

Macroeconomic sensitivity: Financial services companies are inherently cyclical, with performance tied to interest rates, credit cycles, and economic growth. A recession could pressure portfolio company performance and exit valuations, extending hold periods and reducing returns.

Geopolitical complexity: Warburg Pincus's global strategy exposes it to geopolitical risks, from U.S.-China tensions affecting cross-border payments to emerging market currency volatility impacting dollar-denominated returns. Managing these risks requires sophisticated hedging strategies and local market expertise.

Implications for the Broader Market

The successful close of WPFS III sends several signals to the broader private equity ecosystem.

First, it demonstrates that LP appetite for sector-focused strategies remains strong despite the trend toward mega-funds. While generalist funds dominate headlines with $20+ billion raises, specialized vehicles can still attract significant capital by offering differentiated expertise and track records.

Second, it validates financial services as a durable investment theme. Some observers have questioned whether fintech's moment has passed after the 2021-2022 bubble burst. Warburg Pincus's fundraising success suggests sophisticated investors see the digital transformation of financial services as a multi-decade opportunity, not a fleeting trend.

Third, it highlights the importance of global platforms in private equity. Warburg Pincus's ability to invest across North America, Europe, Asia, and Latin America provides diversification and access to higher-growth markets that purely domestic firms cannot match. As emerging markets represent an increasing share of global GDP and financial services growth, this geographic flexibility becomes increasingly valuable.

Finally, it underscores the flight to quality in private equity fundraising. While top-quartile firms like Warburg Pincus continue to raise capital at or above target, many middle-tier managers struggle to close funds or face significant downsizing. The bifurcation of the fundraising market—with capital concentrating among proven performers—is likely to accelerate.

Looking Ahead

As Warburg Pincus begins deploying WPFS III's $3 billion of capital, the firm faces both unprecedented opportunities and formidable challenges. The financial services sector is undergoing its most profound transformation in generations, driven by technology, changing consumer expectations, and regulatory evolution.

The firm's five-decade track record, global platform, and deep sector expertise position it well to navigate this complexity. But past performance, as every fund document reminds investors, is no guarantee of future results. The true test of WPFS III's success will come not in the fundraising—already accomplished—but in the investment selection, value creation, and exit execution over the next 7-10 years.

For now, the fund's oversubscribed close stands as a vote of confidence from the world's most sophisticated institutional investors that Warburg Pincus remains at the forefront of financial services investing. In an industry where reputation and track record are everything, that confidence is perhaps the most valuable asset of all.