The timing couldn't have been worse.

In March 2022, as freight rates peaked and the logistics industry rode high on pandemic-era demand, Columbus, Ohio-based STG Logistics made its biggest bet yet: a $710 million acquisition of XPO Logistics' North American intermodal operations. The deal transformed STG from a regional player operating 28 port locations totaling more than 5 million square feet into one of the nation's largest integrated port-to-door logistics providers.

Less than four years later, that expansion has driven the 40-year-old company into Chapter 11 bankruptcy.

On January 12, 2026, STG Logistics and 64 affiliates filed for voluntary bankruptcy protection in the United States Bankruptcy Court for the District of New Jersey, announcing a prearranged restructuring that will eliminate approximately 91% of its debt and secure up to $150 million of new capital from existing lenders. The company has also arranged $150 million in debtor-in-possession (DIP) financing to maintain operations during what it expects to be a five-month restructuring process.

A Perfect Storm of Bad Timing

STG's bankruptcy filing represents a textbook case of expansion at precisely the wrong moment in the market cycle. The company's massive acquisition closed just as the freight market began a brutal, multi-year decline that would claim some of the industry's most established names.

"Today's announcement marks an important milestone in our efforts to strengthen STG amidst one of the most severe freight recessions in history," said Geoff Anderman, CEO of STG Logistics, in a statement announcing the filing.

The severity of that recession is difficult to overstate. From the market peak in early 2022, freight rates and volumes have declined precipitously, creating what industry participants describe as a "massive freight recession" that has forced widespread consolidation and eliminated thousands of trucking companies.

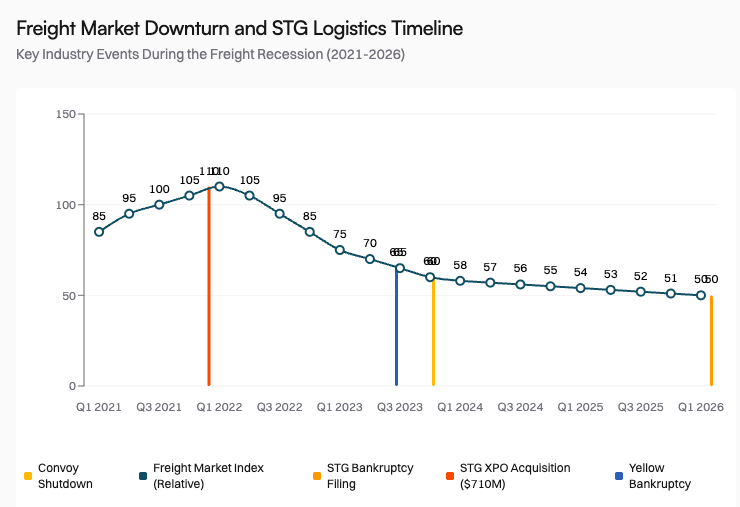

The chart above illustrates the brutal market dynamics that ultimately overwhelmed STG's balance sheet. The freight market index declined over 50% from its Q1 2022 peak of 110 to approximately 50 by early 2026—a sustained downturn that created impossible conditions for highly leveraged operators.

Industry Carnage Signals Systemic Crisis

STG is far from alone in its distress. The freight recession has claimed a growing list of industry casualties, signaling that the company's troubles reflect broader structural challenges rather than isolated mismanagement.

In July 2023, Yellow Corporation—a 99-year-old less-than-truckload carrier with 30,000 employees—shut down operations on July 30 before filing for Chapter 11 bankruptcy on August 6. The collapse of Yellow, once one of the nation's largest LTL carriers, sent shockwaves through the industry and left thousands of workers unemployed.

Just months later in October 2023, digital freight broker Convoy—backed by Jeff Bezos and valued at $3.8 billion at its peak—shut down operations on October 19, citing the "unprecedented freight market collapse." The failure of a well-capitalized, technology-enabled startup underscored that neither innovation nor deep-pocketed investors could overcome the fundamental supply-demand imbalance plaguing the sector.

STG's January 2026 bankruptcy filing continues this troubling trend, with the company explicitly citing financial strain tied to its major intermodal expansion as the proximate cause of its distress.

The XPO Acquisition: Growth at Any Cost

The $710 million XPO acquisition represented a transformational moment for STG. The deal significantly expanded the company's geographic footprint and service capabilities, positioning it as a comprehensive provider of intermodal, drayage, warehousing, and transloading services across every major rail ramp and port in the country.

But the acquisition also saddled STG with substantial debt at precisely the moment when freight market fundamentals were deteriorating. As rates declined and volumes softened throughout 2023 and 2024, the company's ability to service that debt became increasingly strained.

The restructuring announced this week aims to address that fundamental imbalance. By eliminating 91% of its outstanding debt obligations and securing $150 million in fresh capital, STG hopes to reset its balance sheet to sustainable levels while maintaining operational continuity.

A Prearranged Path Forward

Unlike many bankruptcy filings that result from contentious creditor disputes, STG's Chapter 11 process appears relatively orderly. The company has secured a Restructuring Support Agreement (RSA) with its equity sponsors and lenders holding a requisite majority of its funded debt, indicating broad creditor consensus around the restructuring plan.

Transaction Element | Details |

|---|---|

Debt Reduction | Approximately 91% of existing debt eliminated |

New Capital Infusion | Up to $150 million from existing lenders |

DIP Financing | $150 million to support operations during Chapter 11 |

Expected Timeline | Approximately 5 months |

Legal Counsel | Kirkland & Ellis LLP and Cole Schotz P.C. |

Financial & Restructuring Advisor | AlixPartners LLP |

Investment Banker | PJT Partners LP |

Special Committee Counsel | White & Case LLP |

Strategic Communications | C Street Advisory Group |

This prearranged structure should facilitate the company's stated goal of exiting bankruptcy within approximately five months—a relatively swift timeline that suggests strong alignment among key stakeholders.

The company has assembled a heavyweight advisory team to navigate the process. Kirkland & Ellis LLP and Cole Schotz P.C. serve as legal counsel, while AlixPartners LLP handles financial and restructuring advisory. PJT Partners LP serves as investment banker, and C Street Advisory Group manages strategic communications. Notably, White & Case LLP advised the Special Committee of the Board of Managers in connection with the restructuring support agreement, providing independent governance oversight.

Business Continuity Remains Priority

STG has emphasized that operations will continue without interruption throughout the restructuring process. The company has filed typical "first day" motions seeking court approval to pay employee wages and benefits, maintain customer programs, and fulfill payments to key vendors—all standard measures designed to preserve business value during bankruptcy proceedings.

For STG's customers—cargo owners and logistics providers who depend on the company's integrated port-to-door services—this continuity is critical. The company's network of intermodal, drayage, warehousing, and transloading capabilities represents essential infrastructure for supply chains across the country.

"We are confident that leveraging the chapter 11 process will best position the business for long-term growth and success," Anderman said. "I am deeply grateful to our valued team, customers, vendors, and other partners whose support enables us to continue delivering solutions for our customers at the highest levels while staying true to our core values of safety, service, integrity, and efficiency."

Broader Implications for the Logistics Sector

STG's bankruptcy filing raises important questions about the sustainability of debt-fueled consolidation strategies in cyclical industries like freight logistics. The company's experience suggests that aggressive expansion during market peaks can create existential vulnerabilities when the cycle inevitably turns.

The freight recession has exposed fundamental overcapacity in the trucking and logistics sectors. Pandemic-era demand surges prompted massive capacity additions—both through organic growth and acquisitions like STG's XPO deal—that proved unsustainable as e-commerce growth normalized and inventory levels declined.

For private equity sponsors and lenders in the logistics space, STG's restructuring serves as a cautionary tale about the risks of leverage in highly cyclical businesses. While the company's lenders are supporting the restructuring and providing new capital, they're doing so only after accepting massive losses on their original investments.

The question now is whether the freight market has bottomed, or whether further distress lies ahead. Industry forecasts for 2026 suggest a gradual recovery, but most analysts expect a "marginless recovery" characterized by improving volumes but continued rate pressure. In such an environment, even a successfully restructured STG will face challenging operating conditions.

What Comes Next

STG's five-month restructuring timeline suggests the company aims to emerge from bankruptcy by mid-2026, just as the freight market may be showing early signs of recovery. The elimination of 91% of its debt and the infusion of $150 million in new capital should provide the company with a sustainable capital structure and adequate liquidity to weather continued market challenges.

However, the company will emerge into a fundamentally changed competitive landscape. The failures of Yellow and Convoy have eliminated significant capacity from the market, but they've also created uncertainty about which players will survive and thrive in the post-recession environment.

For STG's employees, customers, and vendors, the immediate priority is ensuring operational continuity during the bankruptcy process. The company's ability to maintain service levels and retain key customers will be critical to its post-restructuring success.

For the broader logistics industry, STG's bankruptcy serves as the latest reminder that even well-established companies with strong operational capabilities can be overwhelmed by adverse market conditions when carrying unsustainable debt loads. As the sector continues to work through the aftermath of the freight recession, further consolidation and restructuring appears inevitable.

The freight recession that began in 2023 has fundamentally reshaped the logistics landscape, claiming established players and forcing survivors to reset their cost structures and strategic priorities. STG Logistics' Chapter 11 filing represents another chapter in that ongoing transformation—one that will ultimately determine which companies emerge stronger and which fade into industry history.