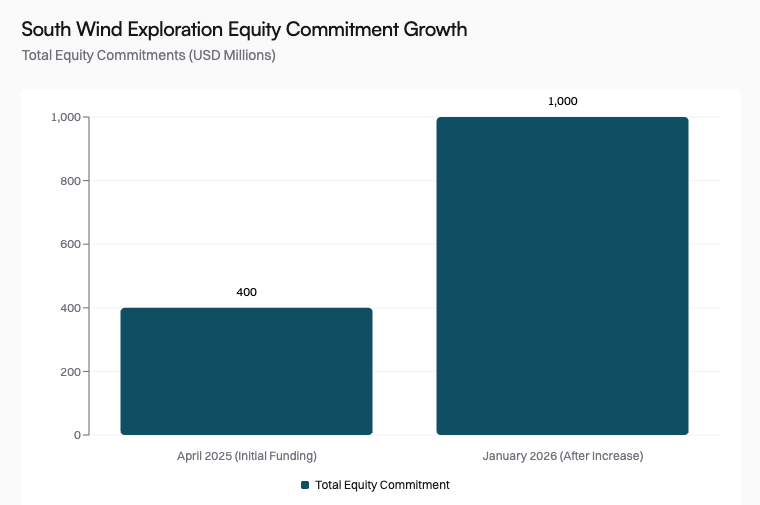

In a striking display of private equity's continued appetite for U.S. oil and gas assets, South Wind Exploration & Production announced it has secured additional equity commitments from Kayne Anderson and Quantum Capital Group, bringing the company's total committed capital to over $1 billion—a remarkable escalation for a firm that didn't exist a year ago.

The Oklahoma City-based independent oil and natural gas company, which was formed in April 2025 with initial equity commitments of over $400 million from Kayne Anderson and Management, has now more than doubled its financial firepower in just eight months. The expanded commitment brings Quantum Capital Group, one of the energy sector's most prolific private equity investors, into the partnership alongside existing backer Kayne Anderson Capital Advisors.

The Deal Structure

Milestone | Date | Investors | Commitment Amount | Cumulative Total |

|---|---|---|---|---|

Company Formation | April 2025 | Kayne Anderson + Management | $400M+ | $400M+ |

Increased Commitment Announcement | January 2026 | Kayne Anderson + Quantum Capital Group | $600M+ (additional) | $1B+ |

The rapid capital escalation reflects a deliberate strategy rather than opportunistic fundraising. According to Mark Teshoian, Managing Partner at Kayne Anderson, the move was designed to position South Wind for transformative acquisitions. "We recognize the critical importance of having access to substantial capital in today's market, and proactively partnering with Quantum further strengthens South Wind's ability to pursue a differentiated large-scale acquisition strategy", Teshoian stated in the announcement.

The deal represents a significant vote of confidence from two of the energy sector's most sophisticated institutional investors. Kayne Anderson, which closed its $2.25 billion Kayne Private Energy Income Fund III in May 2025—the firm's largest energy fund to date—has been aggressively deploying capital into oil and gas opportunities. Quantum Capital Group, founded in 1998, has managed more than $30 billion in capital commitments across the energy value chain since inception and was reportedly seeking to raise $4.5 billion for its ninth flagship oil and gas fund as recently as last year.

Strategic Rationale: Betting on Consolidation

The structure of South Wind's capitalization reveals a clear strategic intent. Rather than launching with modest backing and growing organically, the company secured substantial initial capital, then quickly expanded its war chest before making major acquisitions—a playbook that suggests management and investors see compelling consolidation opportunities in today's market.

Alex Jackson, Partner at Quantum Capital Group, emphasized the team-driven nature of the investment. "This partnership with Kayne Anderson and South Wind represents a compelling opportunity to deploy significant capital behind a team with a proven track record of building scaled, operationally efficient oil and gas platforms", Jackson noted.

That "proven track record" is embodied in South Wind's leadership, including Co-CEO and Co-Founder Tyler Bolton, who brings experience from previous oil and gas ventures. The management team's ability to attract over $1 billion in commitments before completing major acquisitions underscores the premium investors place on operational expertise in the current environment.

Why Now? The Permian Basin Opportunity

The timing of South Wind's capital raise coincides with a unique moment in the Permian Basin, America's most prolific oil-producing region. While oil prices have faced headwinds—with some executives predicting 2026 could mark a "low point" as Permian production capacity ramps up—private equity firms see opportunity in the dislocation.

For investors like Kayne Anderson and Quantum, the calculus is straightforward: acquire quality assets at reasonable valuations, optimize operations, and position for the next cycle. The Permian Basin's infrastructure advantages, including extensive pipeline networks and proximity to Gulf Coast export facilities, make it particularly attractive for scaled operators who can drive efficiencies.

South Wind's strategy appears focused on becoming one of those scaled operators. The company has stated its intention to deploy over $1 billion in onshore U.S. assets, suggesting a portfolio approach rather than a single transformative acquisition. This strategy aligns with broader private equity trends in the energy sector, where firms are increasingly backing consolidators that can aggregate smaller producers and unlock operational synergies.

The Private Equity Energy Playbook Evolves

South Wind's rapid capitalization exemplifies how private equity's approach to energy investing has matured. Rather than the boom-and-bust cycles that characterized earlier eras, today's energy-focused PE firms are deploying capital with greater discipline and longer time horizons.

Kayne Anderson's involvement is particularly notable. The Los Angeles-based firm has been a consistent player in energy private equity for decades, but its recent $2.25 billion fund close—significantly larger than previous vintages—signals conviction that the current environment offers attractive risk-adjusted returns. The firm's strategy of backing multiple portfolio companies simultaneously, including South Wind and other recent investments like Terra Energy Partners II (which secured over $300 million in commitments), suggests a diversified approach to capturing value across different basins and operational profiles.

Quantum Capital Group's entry as a co-investor adds another dimension. While Kayne Anderson specializes in energy income strategies, Quantum has a broader mandate spanning traditional oil and gas, energy infrastructure, renewable power, and decarbonization technologies. The firm's willingness to commit substantial capital to a pure-play oil and gas exploration and production company indicates that traditional hydrocarbons remain central to its investment thesis, despite the energy transition narrative.

The South Wind transaction unfolds against a complex backdrop for oil and gas markets. West Texas Intermediate (WTI) crude prices have been volatile, influenced by global demand concerns, OPEC+ production decisions, and the ongoing energy transition debate. Yet private equity continues to see value in U.S. onshore production, particularly in premier basins like the Permian.

Several factors support this conviction:

Infrastructure maturity: The Permian Basin benefits from decades of infrastructure investment, reducing the capital intensity required for new operators to bring production online.

Operational efficiency gains: Advances in drilling and completion technologies have dramatically reduced breakeven costs, making Permian production economically viable even at lower oil prices.

Consolidation opportunities: A fragmented landscape of smaller producers creates acquisition targets for well-capitalized entrants like South Wind.

Energy security premium: Geopolitical instability has reinforced the strategic value of domestic energy production, potentially supporting long-term demand.

However, challenges remain. The anticipated ramp-up in Permian production capacity could pressure prices in 2026, as some industry executives have warned. Additionally, the long-term trajectory of oil demand remains uncertain as transportation electrification accelerates and renewable energy costs continue to decline.

What This Means for the Industry

South Wind's billion-dollar backing sends several signals to the broader oil and gas sector:

Capital remains available: Despite concerns about ESG pressures and energy transition, substantial institutional capital continues to flow into traditional oil and gas opportunities when backed by strong management teams and clear strategies.

Scale matters: The size of South Wind's commitment suggests that investors believe competitive advantages accrue to larger, more efficient operators—a dynamic that could accelerate consolidation among smaller producers.

The Permian remains king: While other U.S. basins have struggled to attract capital, the Permian Basin continues to dominate investor attention due to its superior economics and infrastructure.

Speed is strategic: South Wind's rapid progression from formation to $1 billion-plus in commitments reflects a market where decisive action and strong relationships can create competitive advantages in deal sourcing.

Looking Ahead

With over $1 billion in committed capital, South Wind Exploration & Production now enters the critical execution phase. The company's ability to identify, acquire, and integrate assets will determine whether this substantial backing translates into returns for Kayne Anderson, Quantum Capital Group, and management.

The broader industry will be watching closely. If South Wind successfully deploys its capital and builds a scaled, efficient platform, it could validate the consolidation thesis and attract additional capital to similar strategies. Conversely, challenges in finding attractive assets at reasonable valuations—or operational missteps—could temper enthusiasm for the model.

For now, the deal stands as a testament to private equity's enduring interest in U.S. oil and gas production. In an era of energy transition uncertainty, sophisticated investors are placing substantial bets that traditional hydrocarbons will remain economically relevant for years to come—and that skilled operators in premier basins can generate attractive returns regardless of the macro environment.

The South Wind story is just beginning, but its rapid ascent from startup to billion-dollar platform offers a window into how private capital is reshaping the American energy landscape, one acquisition at a time.