In a decisive vote of confidence for South Florida's commercial real estate market, Lone Star Funds has acquired The Alhambra office complex in downtown Coral Gables for $119.6 million, or approximately $367 per square foot. The transaction, completed through an affiliate of Lone Star Real Estate Fund VII, L.P., along with affiliates of Highline Real Estate Capital LLC and Square2 Capital LLC, marks the Dallas-based firm's second significant office investment in the region in less than twelve months.

The deal underscores a contrarian thesis gaining traction among institutional investors: while many U.S. office markets struggle with elevated vacancy rates and declining valuations, select Sun Belt markets—particularly South Florida—are experiencing robust fundamentals that justify aggressive capital deployment.

The Alhambra represents exactly the type of trophy asset that has attracted institutional capital to South Florida. The Class A property includes two buildings abutting a Hyatt Regency Hotel and totals 326,451 square feet of office space in the heart of Coral Gables, one of Miami-Dade County's most affluent and economically vibrant submarkets.

Location is paramount in this acquisition. The property sits at the doorstep of Giralda's Restaurant Row, offering tenants immediate access to high-end dining, retail, and hospitality amenities that have become increasingly important in attracting and retaining corporate occupiers in the post-pandemic environment. The buildings feature unobstructed views of both Miami's Brickell financial district and downtown Coral Gables, providing the type of premium workspace experience that commands top-tier rents.

"We have witnessed the tenant migration to Coral Gables driven by a more favorable commute, proximity to Miami's bedroom communities and private schools, and more affordable rents," said Tessa Truex, Managing Director at Lone Star, in the announcement. This migration pattern has fundamentally reshaped South Florida's office landscape, with suburban nodes like Coral Gables capturing market share from traditional urban cores.

The property's institutional tenant base provides stable cash flow—a critical consideration for value-oriented investors like Lone Star who seek assets with strong current income alongside appreciation potential.

A Deliberate South Florida Strategy Emerges

This acquisition is far from opportunistic. It represents the second major office investment Lone Star has made in South Florida within eleven months, following the firm's acquisition of 401 East Las Olas Boulevard, a 410,561-square-foot Class AA office building in Fort Lauderdale in February 2025.

Property | The Alhambra | 401 East Las Olas Boulevard |

|---|---|---|

Location | Downtown Coral Gables, FL | Fort Lauderdale, FL |

Acquisition Date | January 2026 | February 2025 |

Square Footage | 326,451 SF | 410,561 SF |

Property Class | Class A | Class AA |

Purchase Price | $119.6M | Undisclosed |

Price per SF | $366 | - |

Key Features | Two buildings adjacent to Hyatt Regency; near Giralda Restaurant Row; institutional tenants | Most significant Broward County office acquisition in past decade; prime Fort Lauderdale location |

The pattern is unmistakable: Lone Star is systematically building a portfolio of best-in-class office assets across South Florida's strongest submarkets. Combined, these two properties represent over 737,000 square feet of institutional-grade office space and approximately $120 million in disclosed transaction value for The Alhambra alone.

"We continue to see attractive opportunities in this area of the country," said Jérôme Foulon, Global Head of Commercial Real Estate at Lone Star. "We believe that the commercial real estate market in South Florida will continue to grow with more businesses expanding operations in the state."

That conviction is backed by capital. The acquisitions are being made through Lone Star Real Estate Fund VII, which closed in September 2024 with approximately $2.7 billion in capital commitments. The fund is part of Lone Star's broader real estate platform, which has raised approximately $5.3 billion across its fund series.

Market Fundamentals Justify the Conviction

Lone Star's aggressive positioning in South Florida office is supported by exceptional market fundamentals that stand in stark contrast to national trends. While many major U.S. office markets grapple with vacancy rates exceeding 20%, Miami has emerged as a clear outlier.

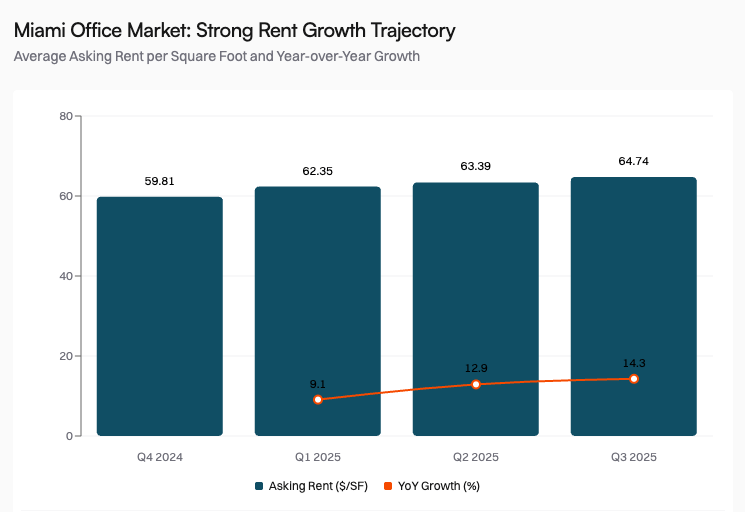

The data tells a compelling story. Miami's office market has experienced average asking rates increasing to $64.74 per square foot, up 14.3% year-over-year as of Q3 2025. This represents not just growth, but accelerating growth—the year-over-year increase has expanded from 9.1% in Q1 2025 to 14.3% by Q3 2025, indicating strengthening pricing power for landlords.

This rental growth is occurring against a backdrop of tight supply-demand fundamentals. Miami posted one of the lowest office vacancy rates among major U.S. markets in 2025, creating an environment where well-located, institutional-quality assets can command premium rents and attract long-term capital.

The migration of businesses and high-income residents to Florida—driven by favorable tax treatment, lifestyle amenities, and improved corporate infrastructure—has created sustained demand for office space. Coral Gables, in particular, has benefited from this trend, with its combination of accessibility, affluence, and amenities making it increasingly attractive to corporate tenants seeking alternatives to higher-cost urban cores.

The Value Proposition: Modest Basis, Strong Upside

At $119.6 million, or approximately $367 per square foot, The Alhambra transaction reveals an interesting pricing dynamic. According to market reports, this represents only a modest gain from the property's last trade a decade ago—a striking contrast to the double-digit rental growth the market has experienced in recent years.

This pricing suggests Lone Star may have identified a value opportunity: acquiring an institutional-quality asset at a relatively modest basis in a market experiencing strong rental growth and tightening fundamentals. If Miami's office market continues its current trajectory, the firm could realize significant appreciation through both rental growth and cap rate compression as the asset's quality and location become increasingly valued.

The partnership structure also merits attention. Lone Star is co-investing with Highline Real Estate Capital and Square2 Capital, both Miami-based firms with deep local expertise and decades of experience operating office properties throughout Florida. This local partnership provides operational capabilities and market intelligence that complement Lone Star's capital and institutional relationships.

The lead principals of these firms have been investing and operating in Florida for over 40 years, with notable projects including Courthouse Commons and Las Olas Square in downtown Fort Lauderdale. This operational expertise will be critical in executing value-creation strategies, whether through lease-up, tenant retention, or property improvements.

Broader Implications for Office Investment

Lone Star's South Florida office strategy offers important insights into how sophisticated institutional investors are approaching the office sector in 2026.

First, it demonstrates that blanket pessimism about office real estate is misplaced. While certain markets and property types face structural challenges, high-quality assets in supply-constrained markets with strong population and economic growth can still attract significant institutional capital at attractive valuations.

Second, the strategy highlights the importance of location and quality. Both of Lone Star's South Florida acquisitions are Class A or Class AA properties in prime locations with strong amenities and access. These are not speculative plays on distressed assets, but rather calculated investments in trophy properties that can command premium rents regardless of broader market conditions.

Third, the partnership approach—combining Lone Star's institutional capital with local operators' expertise—represents a proven model for navigating complex real estate markets. The local partners bring market knowledge, tenant relationships, and operational capabilities that enhance returns and reduce execution risk.

The Lone Star Playbook: Complexity and Value

The South Florida office investments align with Lone Star's broader investment philosophy. Since its founding in 1995, the firm has built its reputation on navigating complex situations and identifying value in assets that are "in flux or complicated by specific structural or financial factors."

With 25 private equity funds and aggregate capital commitments totaling approximately $95 billion, Lone Star has the scale and expertise to execute sophisticated investment strategies across multiple asset classes. The firm's real estate platform focuses on acquiring best-in-class assets with strong locational attributes—a thesis clearly evident in The Alhambra acquisition.

The office sector in 2026 certainly qualifies as "complex" and "in flux." The post-pandemic recalibration of office demand, the flight to quality among tenants, and the divergence between strong and weak markets have created exactly the type of environment where experienced value investors can find opportunities.

Transaction Details and Market Context

JLL Capital Markets represented the seller in the transaction and arranged financing for the new ownership group through Paul Stasaitis and Michael Romero. The involvement of JLL—one of the world's leading commercial real estate services firms—underscores the institutional nature of the transaction.

The financing arrangement is particularly noteworthy given the current commercial real estate lending environment. With many lenders pulling back from office exposure, Lone Star's ability to secure financing for a $120 million acquisition demonstrates both the quality of the underlying asset and the firm's institutional relationships.

The timing of the acquisition is also strategic. By entering the market in early 2026, Lone Star is positioning ahead of what many market observers expect to be a recovery in commercial real estate transaction volumes as interest rates stabilize and pricing clarity emerges.

Looking Ahead: A Market to Watch

Lone Star's commitment to South Florida office real estate sends a clear signal to the broader market: institutional capital is returning to office investments, but it's being deployed selectively in markets with strong fundamentals and high-quality assets.

For South Florida, the implications are significant. If a sophisticated institutional investor like Lone Star is willing to deploy over $120 million into the market within a year, other institutional players are likely evaluating similar opportunities. This could drive increased competition for trophy assets and further support pricing in the region's strongest submarkets.

The success of this strategy will ultimately depend on South Florida's ability to sustain its current momentum. The region's growth has been driven by a confluence of factors—tax advantages, lifestyle appeal, corporate relocations, and population growth—that appear durable but are not guaranteed.

For now, Lone Star is betting that the fundamentals supporting South Florida's office market are strong enough to justify significant capital deployment. With The Alhambra acquisition, the firm has added another premium asset to its growing South Florida portfolio, positioning itself to benefit from what it clearly believes will be continued growth in one of America's most dynamic commercial real estate markets.