The acquisition landscape in third-party logistics rarely produces perfect strategic fits. But when Koch Companies announced its purchase of Store Opening Solutions from Marmon Holdings this week, the deal checked nearly every box for a textbook bolt-on acquisition—one that doubles warehouse capacity, expands geographic reach, and deepens sector-specific expertise in a single transaction.

The Minneapolis-based transportation and logistics company, celebrating its 50th anniversary in 2026, is acquiring the Murfreesboro, Tennessee-based retail inventory consolidation specialist in a move that transforms Koch from a Midwest-focused 3PL provider into a multi-regional logistics network. Financial terms were not disclosed, but the strategic rationale is crystal clear: the acquisition doubles Koch's nationwide warehouse footprint, expanding from more than three million square feet to approximately 6 million square feet of warehouse facilities.

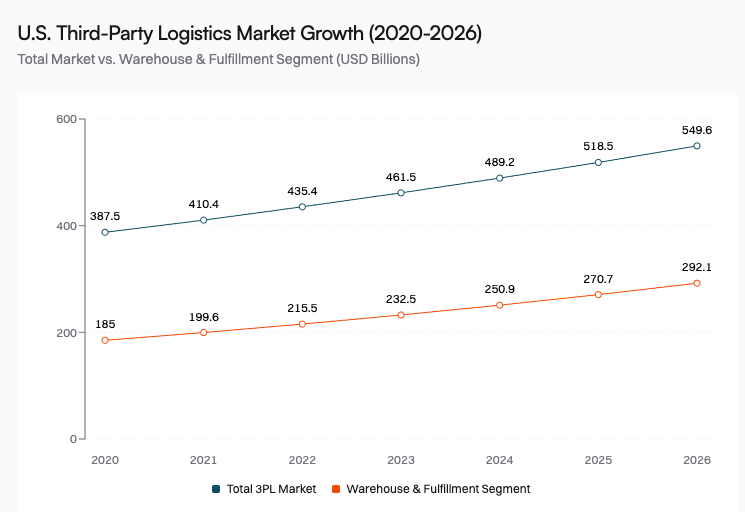

"Bringing SOS into the Koch Companies family represents a meaningful step in our long-term strategy to strengthen and expand our logistics, fulfillment, and trucking capabilities," said Jeff Koch, Chief Operating Officer of Koch Companies, in the announcement. The deal arrives at a pivotal moment for the logistics industry, as warehouse and fulfillment services emerge as the fastest-growing segment of the U.S. third-party logistics market.

The Strategic Logic: Scale, Geography, and Specialization

Metric | Pre-Acquisition (Koch Only) | Post-Acquisition (Koch + SOS) | Change |

|---|---|---|---|

Total Warehouse Square Footage | 3M+ sq ft | ~6M sq ft | 100% increase |

Number of Warehouse Locations | Multiple Midwest facilities | Midwest + 5 SOS facilities | +5 facilities |

Primary Geographic Coverage | Midwest region | Midwest + TN, MS, NH | 3 new states |

Geographic Reach | Regional (Midwest) | Multi-regional | National expansion |

Retail Sector Specialization | General 3PL | Retail inventory consolidation added | Specialized retail capabilities added |

Strategic Positioning | Midwest's largest private 3PL | Multi-regional 3PL | Regional to national transformation |

The Store Opening Solutions acquisition delivers three distinct strategic advantages that position Koch Logistics & Warehousing for accelerated growth in an increasingly competitive market.

Capacity at Scale: Doubling warehouse capacity in a single transaction represents the largest expansion in Koch's five-decade history. The company was already one of the Midwest's largest privately owned third-party logistics solutions providers, but the 100% increase in physical infrastructure fundamentally changes its competitive positioning. In an industry where capacity constraints have become a persistent challenge, particularly in high-demand fulfillment corridors, this expansion provides immediate operational leverage.

Geographic Diversification: Perhaps more significant than raw square footage is the geographic transformation. Store Opening Solutions brings five locations in Tennessee, Mississippi, and New Hampshire, instantly extending Koch's reach beyond its Midwest stronghold into the Southeast and Northeast. This multi-regional footprint is increasingly essential for serving national retailers and e-commerce companies that require distributed inventory networks to meet consumer delivery expectations.

The Southeast presence is particularly strategic. Tennessee has emerged as a logistics hub over the past decade, with its central location, favorable business climate, and proximity to major population centers making it a magnet for warehouse development. Koch's acquisition of SOS facilities in the region provides an established footprint in one of the nation's fastest-growing logistics markets.

Retail Sector Expertise: Beyond scale and geography, the deal adds specialized capabilities that differentiate Koch in the crowded 3PL landscape. Store Opening Solutions provides inventory consolidation of retail fixtures and other not-for-resale goods, serving retailers with store opening, expansion, and remodel needs. This niche expertise complements Koch's general logistics offerings with sector-specific knowledge that commands premium pricing and creates stickier customer relationships.

A Partnership 25 Years in the Making

What makes this acquisition particularly compelling is its foundation in an existing operational relationship. Koch Logistics has maintained a 25-year history working alongside SOS, with Koch operating an onsite team at the Murfreesboro location since 1999. Together, the companies have partnered to support some of the country's largest retailers through store expansion and brand conversion projects.

This extended partnership history significantly de-risks the integration process. Unlike acquisitions where cultural misalignment and operational incompatibility create post-deal friction, Koch and SOS have spent a quarter-century developing shared processes, customer relationships, and operational rhythms. The companies already know how to work together—they're simply formalizing the relationship under unified ownership.

"Koch Logistics has a 25-year history working alongside SOS, and we are extremely excited about what the future holds as we blend the best of both companies," said Darren Nelson, Vice President & General Manager of Koch Logistics and Warehousing. "Bringing both entities under the same umbrella, having a shared vision and strategy, will allow us to create synergies and value-added solutions for our clients."

The operational familiarity also suggests that Koch has had an extended period to evaluate SOS's business quality, customer relationships, and growth potential—far more due diligence time than typical M&A processes allow. This inside perspective on the target's operations is a significant advantage that should facilitate faster integration and value capture.

Riding the Warehouse and Fulfillment Wave

The timing of Koch's warehouse capacity expansion aligns with powerful secular trends reshaping the logistics industry. The Value-Added Warehousing & Distribution (VAWD) segment held 49.3% of the U.S. 3PL market share in 2024, making it the dominant service category within third-party logistics. More importantly, this segment is advancing at a 7.9% CAGR toward 2030—significantly outpacing the overall 3PL market's growth rate.

The warehouse and fulfillment segment's accelerated growth reflects fundamental changes in retail and consumer behavior. E-commerce penetration continues to climb, requiring dense fulfillment networks positioned close to population centers. Retailers are simultaneously grappling with inventory complexity as they manage omnichannel strategies that blend physical stores, online sales, and various fulfillment options. This complexity creates demand for specialized services like the inventory consolidation capabilities that Store Opening Solutions provides.

The broader U.S. third-party logistics market presents a massive opportunity. The market was estimated at $435.43 billion in 2022, and is projected to garner $1028.24 billion by 2032, representing a compound annual growth rate that reflects the ongoing outsourcing of logistics functions by companies seeking to focus on core competencies while leveraging specialized providers' scale and expertise.

For Koch Companies, the SOS acquisition positions the firm to capture a larger share of this growth, particularly within the warehouse and fulfillment segment where the company now has significantly enhanced capacity and capabilities.

The Marmon Holdings Divestiture Context

The seller in this transaction, Marmon Holdings, is a Chicago-based industrial holding company owned by Berkshire Hathaway. Marmon Group primarily focuses on the industrial space, including companies that produce transportation equipment, electrical components, other industrial components, as well as service-based companies providing services in the construction and retail sectors.

While Marmon has not publicly disclosed its rationale for divesting Store Opening Solutions, the sale likely reflects portfolio optimization within Berkshire Hathaway's broader industrial holdings. Store Opening Solutions, while a solid business serving retail clients, may have represented a non-core asset within Marmon's portfolio—particularly if the parent company is focusing capital and management attention on other industrial segments with higher growth potential or better strategic fit.

For Koch Companies, acquiring from a sophisticated seller like Marmon provides additional validation of the asset quality. Berkshire Hathaway-owned companies are typically well-managed operations with strong fundamentals, suggesting that Koch is acquiring a business with solid operational foundations.

Koch's Broader Strategic Trajectory

The Store Opening Solutions acquisition fits within Koch Companies' stated intention to pursue additional strategic acquisitions, with particular emphasis on warehousing and fulfillment capabilities. This signals that the SOS deal is not a one-off transaction but rather part of a deliberate build-out strategy in the logistics sector.

Koch Companies comprises five divisions: Koch Trucking, Koch Logistics & Warehousing, Koch NationaLease, United Trailer Leasing, and Koch Maritime. This diversified structure positions the company to offer integrated transportation and logistics solutions across multiple modes and service categories. The warehouse capacity expansion strengthens the logistics division while creating additional opportunities for cross-selling trucking, leasing, and other services to the expanded customer base.

The company's 50-year operating history provides a stable foundation for this growth strategy. Family-owned businesses like Koch Companies often take longer-term perspectives on investment and growth compared to private equity-backed competitors operating under finite fund timelines. This patient capital approach can be a competitive advantage in logistics, where customer relationships, operational excellence, and network effects compound over extended periods.

Integration Challenges and Opportunities

Despite the strong strategic rationale and existing partnership foundation, Koch still faces meaningful integration challenges. Doubling warehouse capacity requires more than simply adding square footage—it demands integrated systems, standardized processes, and unified customer service across all facilities.

The geographic expansion into new regions brings operational complexity. Koch will need to establish or strengthen relationships with local carriers, navigate different labor markets, and potentially adapt service offerings to regional customer preferences. The company's existing presence in Murfreesboro since 1999 provides a head start, but scaling operations across Tennessee, Mississippi, and New Hampshire will require focused execution.

The retail specialization that Store Opening Solutions brings also creates opportunities for Koch to deepen relationships with existing customers while potentially attracting new retail clients seeking comprehensive logistics partners. However, successfully cross-selling services across the combined entity will require careful coordination between sales teams and operational groups.

Industry Implications and Competitive Dynamics

The Koch-SOS transaction reflects broader consolidation trends in the fragmented third-party logistics industry. While the 3PL market includes numerous large players, it remains highly fragmented with thousands of regional and specialized providers. Strategic acquisitions by established operators like Koch Companies represent a pathway to build scale, expand capabilities, and compete more effectively against both large national 3PLs and emerging technology-enabled logistics platforms.

For competitors, the deal signals that warehouse capacity and retail sector expertise are valuable strategic assets worth pursuing through M&A. Other regional 3PL providers may accelerate their own acquisition strategies to avoid being left behind as larger players consolidate market share.

For customers, particularly national retailers, the expanded Koch platform offers potential benefits through broader geographic coverage and enhanced service capabilities. However, customers will be watching closely to ensure that integration execution maintains service quality and that the combined entity delivers on the promised synergies.

Looking Ahead: A Platform for Continued Growth

Koch Companies has explicitly stated its intention to continue pursuing strategic acquisitions focused on warehousing and fulfillment. The successful integration of Store Opening Solutions will serve as a proof point for the company's ability to execute on this strategy and could accelerate the pace of future deals.

The company's 50th anniversary provides a symbolic milestone for this strategic evolution—from a trucking company founded in 1976 to a diversified transportation and logistics platform positioned for its next phase of growth. The SOS acquisition represents not just a capacity expansion but a statement of strategic intent: Koch Companies is building a multi-regional logistics network capable of serving sophisticated customers with complex supply chain needs.

In an industry where scale, specialization, and geographic reach increasingly determine competitive positioning, Koch's move to double its warehouse footprint while adding retail sector expertise positions the company to capture a larger share of the fast-growing third-party logistics market. The deal's success will ultimately be measured not just by the immediate capacity addition but by Koch's ability to leverage this expanded platform for sustained growth in the years ahead.