The U.S. plant-based snacking market has attracted a new international player. USK Capital, the family office of Indian banking magnate Uday Kotak, has acquired a majority stake in Go Raw, a Chicago-area seed-based snacking brand, from Washington, D.C.-based private equity firm Juggernaut Capital Partners. The transaction, announced January 13, 2026, marks USK Capital's first overseas and consumer sector investment, representing a strategic expansion beyond the family office's traditional financial services focus.

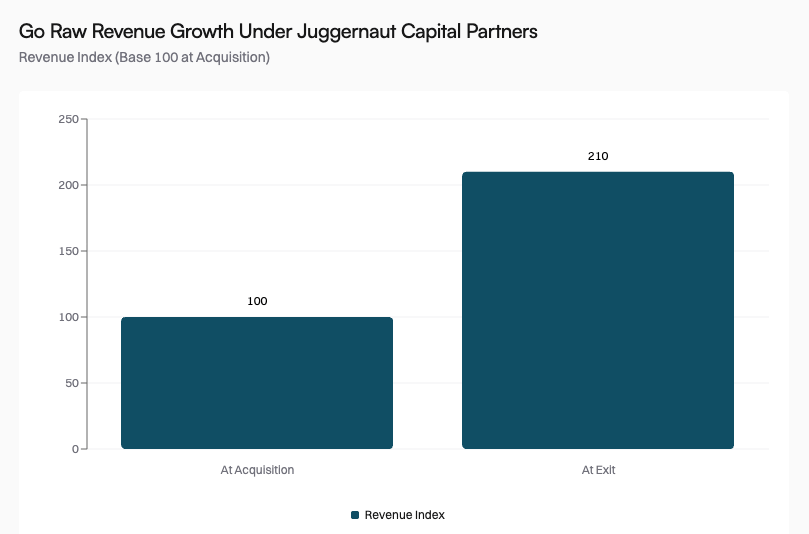

Financial terms were not disclosed, but the deal comes after Juggernaut successfully transformed Go Raw's business model and market position. During the private equity firm's ownership period, Go Raw more than doubled revenue while broadening distribution across grocery, natural, club and e-commerce channels.

The Buyer: Banking Wealth Meets Consumer Ambition

USK Capital represents the investment vehicle of Uday Suresh Kotak, founder and former CEO of Kotak Mahindra Bank Ltd., India's third-largest private sector bank with a market capitalization of $47B USD. The Kotak family currently owns ~26% of the bank, providing substantial capital for diversification beyond financial services.

The Go Raw acquisition signals a deliberate pivot toward consumer investments and international markets. For a family office built on India's banking sector, the move into U.S. consumer packaged goods represents both geographic and sectoral diversification—a strategy increasingly common among ultra-high-net-worth families seeking exposure to secular growth trends like health and wellness.

The timing is notable. As Indian banking faces regulatory pressures and market saturation, the Kotak family appears to be deploying capital into high-growth consumer categories abroad. The plant-based and better-for-you snacking segment offers exposure to powerful demographic trends: millennial and Gen Z consumers prioritizing health, sustainability, and clean-label products.

The Seller: Value Creation Through Operational Excellence

Juggernaut Capital Partners executed a textbook private equity playbook with Go Raw. The lower middle-market private equity firm focuses on consumer and healthcare sectors, partnering with management teams to drive sustainable growth through operational improvements, strategic expansion and disciplined execution.

"Go Raw has established itself as a differentiated brand within the rapidly growing plant-based snacking category," said Alex Deegan, Managing Director at Juggernaut Capital Partners. "In partnership with management, we helped scale the business, professionalize operations and support innovation and distribution expansion."

The firm's value creation strategy focused on three core pillars: infrastructure development, distribution expansion, and product innovation. Juggernaut acquired Go Raw with the objective of accelerating the Company's growth, strengthening its operating infrastructure and expanding its national retail footprint.

The results speak to effective execution. Revenue more than doubling during a private equity hold period represents strong performance, particularly in the competitive snacking category where shelf space is precious and consumer loyalty is hard-won.

The Target: Sprouted Seeds Meet Consumer Wellness

Go Raw, operating as Freeland Foods LLC and based in the Chicago, IL area, has carved out a distinctive position in the crowded snacking market. The company was founded on the principle of transforming mindless snacking into mindful snacking, offering a range of sprouted seeds, snacking granola, salad toppers and cluster snacks.

The brand's differentiation lies in its sprouting process and clean-label credentials. Go Raw's products are USDA-Certified Organic, Non-GMO Project Verified, meeting multiple dietary preferences and tapping into the clean-label movement that has reshaped food retail over the past decade.

The sprouting process itself provides a nutritional edge. By activating seeds before processing, Go Raw enhances digestibility and nutrient bioavailability—a technical advantage that resonates with health-conscious consumers willing to pay premium prices for functional benefits.

Distribution expansion proved critical to Go Raw's growth trajectory. The company moved beyond its natural foods channel roots to establish presence across conventional grocery, club stores like Costco and Sam's Club, and e-commerce platforms. This omnichannel approach provided multiple paths to consumers and reduced dependence on any single retail format.

Market Context: The Plant-Based Snacking Opportunity

Go Raw's growth story unfolds against a backdrop of surging consumer interest in plant-based and better-for-you snacking options. The snacking landscape is being reshaped by shifting consumer preferences, health and wellness trends, and technological advancements, creating opportunities for brands that can authentically deliver on health and sustainability promises.

The plant-based snacks category has experienced robust growth, driven by consumers seeking alternatives to traditional snack foods laden with artificial ingredients, excessive sodium, and refined carbohydrates. Clean-label products—those with recognizable, minimal ingredients—have moved from niche to mainstream, with major retailers dedicating expanded shelf space to the category.

Seed-based snacks occupy a particularly attractive niche within this broader trend. Unlike nut-based alternatives, seeds offer allergen-friendly options for consumers with tree nut sensitivities. They also provide distinct nutritional profiles, with pumpkin seeds, sunflower seeds, and other varieties offering protein, healthy fats, and micronutrients.

The market dynamics favor established brands with distribution scale. As retailers consolidate shelf space and prioritize proven performers, Go Raw's expanded footprint across multiple channels provides competitive advantages that would be difficult for new entrants to replicate quickly.

Transaction Structure and Advisors

USK Capital acquired a majority stake in Freeland Foods LLC through a secondary transaction, purchasing Juggernaut Capital Partners' position. The structure suggests management may have retained a minority stake, a common arrangement that maintains leadership continuity and aligns incentives for future growth.

Stifel served as financial advisor to Juggernaut Capital Partners, while Robinson, Bradshaw & Hinson, P.A. served as legal advisor. The involvement of Stifel, a prominent middle-market investment bank, indicates a competitive sale process likely attracted multiple bidders.

The decision to sell to a family office rather than another private equity firm or strategic buyer carries implications for Go Raw's future. Family offices typically operate with longer time horizons than traditional PE funds, potentially providing management with more runway to execute growth initiatives without near-term exit pressure.

Strategic Implications and Future Outlook

For USK Capital, the Go Raw acquisition represents a calculated entry into the U.S. consumer market with a differentiated asset. Rather than competing in crowded categories or acquiring turnaround situations, the family office selected a brand with proven growth, established distribution, and alignment with secular consumer trends.

The deal also reflects growing international interest in U.S. consumer brands, particularly those with health and wellness positioning. As emerging market wealth seeks diversification, American consumer companies with strong brand equity and growth trajectories become attractive targets.

Go Raw's management now faces the challenge of sustaining momentum under new ownership. The company must continue innovating its product portfolio, defending shelf space against competitors, and potentially exploring new distribution channels or geographic markets. International expansion could be on the horizon, particularly given USK Capital's Indian connections and potential distribution networks in South Asian markets.

The plant-based snacking category shows no signs of slowing. As consumers increasingly view snacking as an opportunity for nutrition rather than indulgence, brands like Go Raw that deliver functional benefits alongside taste and convenience are well-positioned for continued growth.

Broader Industry Trends

This transaction fits within a larger pattern of private equity activity in the better-for-you food and beverage sector. Investors have poured capital into brands that align with consumer preferences for health, sustainability, and transparency, betting that these secular trends will drive long-term growth despite premium pricing.

The exit also demonstrates that lower middle-market private equity firms can generate attractive returns in consumer brands through operational improvements and distribution expansion, even without transformative M&A or dramatic market share gains. Juggernaut's playbook—professionalize operations, expand distribution, support product innovation—represents a replicable strategy for similar platforms.

For entrepreneurs building consumer brands, the Go Raw story offers a roadmap: establish differentiation through product innovation, secure clean-label certifications that resonate with target consumers, expand distribution methodically across channels, and build operational infrastructure that can scale. These fundamentals attract private equity capital and ultimately create exit opportunities.

Conclusion

The sale of Go Raw from Juggernaut Capital Partners to USK Capital represents more than a simple change of ownership. It signals the maturation of the plant-based snacking category, the growing sophistication of family office investing, and the continued attractiveness of U.S. consumer brands to international capital.

As Uday Kotak's family office makes its first foray into American consumer markets, Go Raw gains a well-capitalized owner with long-term orientation and potential access to new markets. For Juggernaut Capital Partners, the exit validates its operational value creation strategy and returns capital for deployment into new opportunities.

The sprouted seed snacks that Go Raw pioneered have moved from health food stores to mainstream retail—a journey that mirrors the broader evolution of better-for-you foods from niche to necessity. With new ownership and continued consumer tailwinds, the brand's next chapter promises further growth in a category that shows no signs of slowing.

Deal Overview

Buyer (USK Capital) | Seller (Juggernaut Capital Partners) | Target Company (Go Raw) | |

|---|---|---|---|

Entity Name | USK Capital | Juggernaut Capital Partners (JCP) | Go Raw (operated by Freeland Foods LLC) |

Leadership/Ownership | Family office of Uday Suresh Kotak, founder and former CEO of Kotak Mahindra Bank Ltd., India's third-largest private sector bank with $47B market cap; Kotak family owns ~26% of the bank | Lower middle-market private equity firm | Management team worked in partnership with Juggernaut Capital Partners |

Headquarters | India | Washington, D.C. | Chicago, IL area |

Investment Focus | First overseas and consumer sector investment; focus on healthy eating trends and U.S. market growth potential | Consumer and healthcare sectors; operational improvements, strategic expansion, and disciplined execution | Seed-based snacking in the plant-based, better-for-you category |

Market Position | Entering U.S. consumer market through acquisition | Successful exit after value creation; positioned company for next phase of growth | Differentiated brand in rapidly growing plant-based snacking category; revenue more than doubled under JCP ownership |

Product Portfolio | - | - | Sprouted seeds, snacking granola, salad toppers, cluster snacks; minimally processed, clean-label products |

Certifications | - | - | USDA-Certified Organic, Non-GMO Project Verified |

Strategic Rationale | Entry into U.S. consumer market; exposure to healthy eating and plant-based snacking trends; maiden foreign investment | Successful exit after achieving operational improvements, revenue growth, and distribution expansion across grocery, natural, club, and e-commerce channels | Well positioned for next phase of growth with strengthened infrastructure and expanded national retail footprint |

Transaction Role | Acquired majority stake via secondary transaction | Exited investment after successful value creation period | Transaction announced January 13, 2026 |

Go Raw's Growth Trajectory