Hurricane Capital's acquisition of Kiyomi AI marks the latest move in the New York-based asset manager's calculated campaign to position itself at the forefront of artificial intelligence-driven institutional trading. The deal, announced Monday, comes just over a year after the firm's strategic investment in Transient.AI and underscores a broader industry shift toward AI-powered execution and portfolio intelligence.

The transaction brings Kiyomi AI—a portfolio intelligence platform developed by Jacob Koenig, former Head of Taiwan Execution Services at Goldman Sachs—into Hurricane Capital's growing technology ecosystem. Financial terms were not disclosed.

The Strategic Architecture

What sets this acquisition apart is not merely the addition of another AI tool, but the deliberate architectural integration Hurricane Capital is orchestrating. Kiyomi AI will be embedded at the core of Transient.AI's platform, powered by what the company calls its proprietary Declarative AI framework.

"Kiyomi means 'Pure Sight' in Japanese, and that's exactly what we're building: an awareness layer that cuts through the noise to show you what's actually moving your book and why," Koenig said in a statement. "Hurricane's technology is years ahead of the industry, and Kiyomi is a showcase of what's possible when deep market expertise meets cutting-edge AI."

The platform promises to deliver what institutional traders have long sought: real-time visibility into portfolio drivers and market patterns, backed by both algorithmic sophistication and human trading expertise. Koenig's background in executing trades for Taiwan-based institutional clients at Goldman Sachs brings a critical dimension of market-structure knowledge that purely quantitative approaches often lack.

Platform | Year | Transaction Type | Key Capabilities | Strategic Focus |

|---|---|---|---|---|

2025 | Strategic Investment | Declarative AI framework powering four enterprise SaaS platforms: CaddieAI (hedge fund sales/trading/research), ClarityRIA (wealth management insights), CapFlo.AI (derivatives intelligence), and Sales+AI (trader recommendations) | Foundation platform delivering real-time, data-driven intelligence by synthesizing market data, client history, headline risk, and regulatory constraints for institutional finance workflows | |

Kiyomi AI | 2026 | Acquisition | Next-generation portfolio intelligence layer combining institutional trading knowledge and market-structure expertise to identify patterns and drivers; "Pure Sight" awareness layer for execution intelligence | Embedded at the core of Transient.AI to create new standard for execution intelligence, enabling AI-driven trading capabilities with institutional-grade governance and security |

Building the AI Trading Stack

Hurricane Capital's approach reflects a methodical build-out of complementary capabilities rather than a scattershot technology acquisition strategy. The firm's 2025 investment in Transient.AI established the foundational layer—a Declarative AI framework supporting four enterprise-grade AI SaaS platforms including CaddieAI for hedge fund operations, ClarityRIA for wealth management, CapFlo.AI for derivatives workflows, and Sales+AI for trader recommendations.

Now, with Kiyomi AI, Hurricane adds the intelligence layer specifically designed for execution—the critical moment where trading decisions translate into actual market positions. This combination creates what the firm describes as "a new standard for execution intelligence," offering institutional-grade governance, security, and data control alongside AI-driven insights.

The integration strategy is telling. Rather than operating Kiyomi as a standalone product, Hurricane is weaving it into Transient.AI's existing infrastructure. This suggests the firm envisions a unified platform where portfolio intelligence, execution capabilities, and institutional workflows converge—a one-stop solution for fund managers across asset classes.

The Booming AI Trading Market

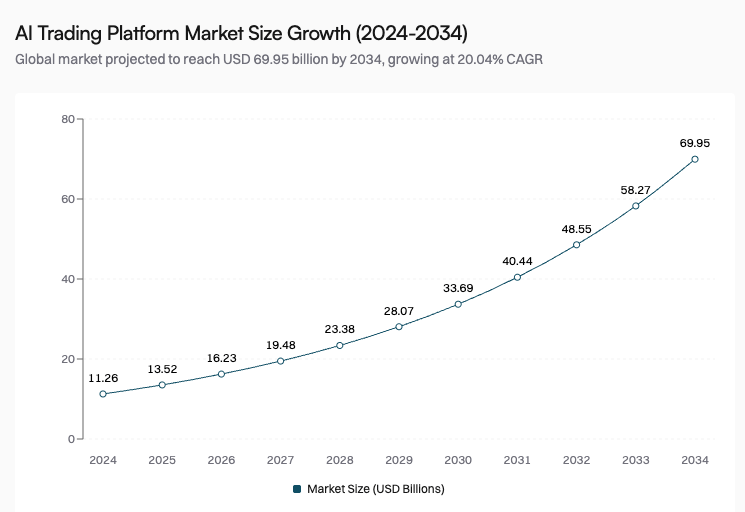

Hurricane Capital's aggressive positioning comes as the AI trading platform market experiences explosive growth. The global market, valued at $11.26 billion in 2024, is projected to reach $69.95 billion by 2034, expanding at a 20.04% compound annual growth rate.

That growth is being driven by multiple converging forces. Institutional investors, who held 61% of the algorithmic trading market share in 2024, are increasingly demanding speed, accuracy, and real-time data processing capabilities that only AI-powered systems can deliver at scale. Meanwhile, retail investors—projected to grow at 10.8% CAGR through 2030—are gaining access to sophisticated trading tools once reserved for institutional players.

The technology itself is evolving rapidly. While high-frequency trading firms continue pushing the boundaries of sub-microsecond execution, most organizations are now focused on achieving the most predictive, robust AI models. One leading European trading organization recently invested over €1 billion in Nordic data centers—not primarily for speed, but to support AI-driven forecasts across 50,000+ financial instruments and build scalable solutions capable of handling exponential data growth.

What Institutional Traders Actually Need

The challenge in institutional trading isn't simply executing orders faster—it's understanding why portfolios are moving and what factors are driving performance in real-time. Traditional execution management systems (EMS) provide traders with real-time market data, access to various trading venues, and advanced execution options, but they often lack the interpretive layer that connects market movements to portfolio outcomes.

This is where Kiyomi AI's "awareness layer" concept becomes relevant. By combining Koenig's institutional trading expertise with AI pattern recognition, the platform aims to surface the signal within the noise—identifying which market factors are materially impacting specific positions and why.

For fund managers, this capability could prove transformative. Rather than reacting to portfolio movements after the fact, traders could potentially anticipate how emerging market conditions will affect their books and adjust positions accordingly. The platform's integration with Transient.AI's broader suite means these insights can flow directly into execution workflows, compliance systems, and client reporting.

The Competitive Landscape

Hurricane Capital isn't alone in recognizing the opportunity. The AI trading technology sector has attracted significant investment as traditional asset managers, fintech startups, and established financial technology vendors all compete for market share.

What differentiates Hurricane's approach is its focus on institutional-grade infrastructure from the outset. Many AI trading platforms target retail investors or smaller fund managers with cloud-based, app-driven interfaces. Hurricane, by contrast, is building for the institutional market where security, governance, data control, and regulatory compliance are non-negotiable requirements.

The firm's emphasis on "institutional-grade governance" and "massively scalable AI model orchestration" suggests it's positioning for enterprise clients managing billions in assets—organizations that need more than clever algorithms. They need systems that can integrate with existing technology stacks, meet regulatory standards, and scale across multiple asset classes and geographies.

The Goldman Sachs Connection

Koenig's pedigree matters in this context. Goldman Sachs' execution services desks are among the most sophisticated in global finance, handling complex institutional order flow across multiple markets and asset classes. The Taiwan desk, in particular, deals with the intricacies of Asian market structure, cross-border flows, and the unique challenges of executing large institutional orders in markets with different liquidity profiles than U.S. exchanges.

That experience translates directly into Kiyomi AI's value proposition. Understanding market microstructure—how orders actually get filled, where liquidity resides, and how different execution strategies impact outcomes—requires years of hands-on trading experience that can't be replicated through data analysis alone. Combining that domain expertise with AI's pattern recognition capabilities creates a potentially powerful hybrid approach.

Strategic Implications

For Hurricane Capital, the Kiyomi acquisition represents more than technology accumulation—it's a strategic repositioning. The firm, which describes itself as focused on "the continual advancement of AI innovation in finance," is effectively transforming from a traditional asset manager into a technology-enabled investment platform.

This evolution mirrors broader trends in asset management, where the lines between investment firms and technology companies are increasingly blurred. Firms like Bridgewater Associates, Two Sigma, and Renaissance Technologies have long competed on technological sophistication. Hurricane appears to be making a similar bet—that superior AI infrastructure will become a primary source of competitive advantage in institutional trading.

The timing is strategic. As AI trading platforms proliferate, the window for establishing market leadership is narrowing. By moving aggressively to build a comprehensive technology stack—from foundational AI frameworks to specialized execution intelligence—Hurricane is positioning itself to capture institutional clients before competitors can assemble comparable capabilities.

Challenges Ahead

Despite the promising market dynamics, significant challenges remain. The AI trading space faces escalating technological demands, complex regulatory landscapes, and fierce competition. Success requires more than powerful algorithms—it demands integrated solutions capable of handling everything from microsecond trading to massive AI-driven data analysis.

Data quality presents another hurdle. A primary constraint in the AI trading platform market is the lack of high-quality, domain-specific data for training and deploying AI models. While Hurricane's institutional focus may provide access to better data than retail-oriented competitors, the firm will still need to demonstrate that its models can consistently outperform in live trading environments.

Regulatory scrutiny is intensifying as well. As AI systems take on greater roles in trading decisions, regulators worldwide are grappling with questions about algorithmic accountability, market stability, and systemic risk. Hurricane's emphasis on institutional-grade governance suggests awareness of these concerns, but navigating the evolving regulatory landscape will require ongoing investment and adaptation.

The Road Ahead

Hurricane Capital has signaled its ambitions clearly: to redefine institutional trading through artificial intelligence. The Kiyomi acquisition provides another building block in that vision, adding execution intelligence to the firm's growing technology platform.

Whether this strategy succeeds will depend on execution—both technological and commercial. Can Hurricane's integrated platform deliver measurably better outcomes for institutional traders? Will fund managers embrace a technology stack from an asset manager rather than established fintech vendors? Can the firm scale its infrastructure to handle the demands of large institutional clients across multiple asset classes?

The answers will emerge over the coming years as Hurricane's AI trading ecosystem moves from concept to operational reality. For now, the firm has made its bet: that the future of institutional trading belongs to those who can combine deep market expertise with cutting-edge AI capabilities—and that the window to establish leadership in this space is open, but closing fast.

As Koenig put it, the goal is "pure sight"—the ability to see through market noise to what's actually driving portfolio performance. In an industry where milliseconds and basis points matter, that clarity could prove invaluable. Whether Hurricane Capital can deliver on that promise will determine if this acquisition marks a turning point in AI-driven institutional trading or simply another chapter in the ongoing technology arms race.