The collision repair industry's latest consolidation play comes with a twist: rather than pursuing aggressive growth at any cost, Collision Partners is betting that a "quality-first" approach can differentiate its platform in a market where more than 130 private equity firms have expressed interest in recent years.

The Raleigh, North Carolina-based company announced Monday the completion of its first two acquisitions—Fantastic Finishes and Chassis Master—marking the formal launch of a consolidation strategy focused on the Southeastern United States. The deals bring together complementary capabilities: Fantastic Finishes is widely regarded as one of the premier collision-repair operations in the United States, known for uncompromising craftsmanship, while Chassis Master is a 75-year-old, multi-generational family business with a strong luxury OEM and dealership repair portfolio.

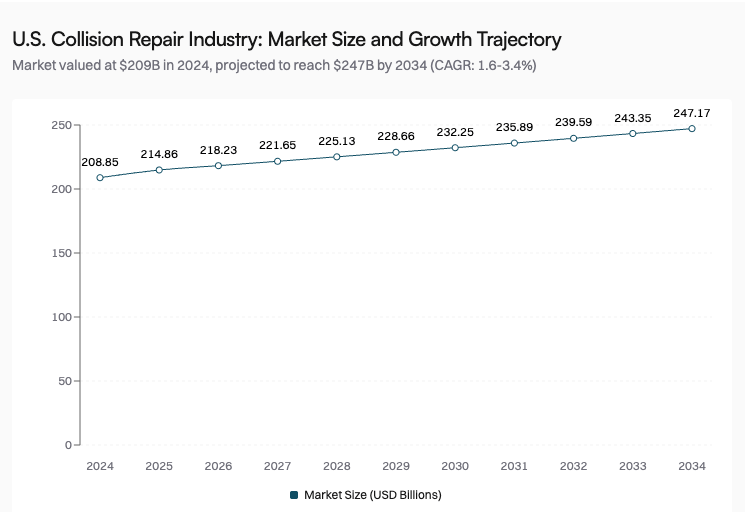

The timing is strategic. While the collision repair industry's five largest consolidators have pulled back on acquisitions in 2025, private equity firms increased their investments, creating new opportunities for independent shops. Collision Partners is entering a market valued at $208.85 billion in 2024, growing to $214.86 billion in 2025, with long-term projections suggesting the sector could reach $247.17 billion by 2034.

A Fragmented Industry Ripe for Consolidation

The collision repair sector remains one of the most fragmented industries in the automotive aftermarket. Despite years of consolidation activity, the largest operators controlled approximately one-third of the collision repair market share by the end of 2024, meaning roughly two-thirds of the market remains in the hands of independent operators.

This fragmentation creates both opportunity and challenge. The $48 billion annual U.S. market offers substantial room for growth, but the industry's complexity—ranging from insurance relationships to OEM certification requirements—has proven difficult for many consolidators to navigate while maintaining quality standards.

The market dynamics are shifting in ways that favor well-capitalized platforms. Rising vehicle complexity, particularly the proliferation of advanced driver assistance systems (ADAS), requires significant capital investment in equipment and technician training. Independent shops face mounting pressure to either invest heavily or risk losing access to lucrative OEM and dealership repair work.

"The collision repair landscape is rapidly evolving," said Earl Johnson IV, CEO and Co-Founder of Collision Partners, in the company's announcement. The platform's approach to Fantastic Finishes and Chassis Master is rooted in partnership—preserving the reputation, relationships, and operational strengths that make the businesses extraordinary.

Strategic Acquisitions: Complementary Capabilities

The two inaugural acquisitions reveal Collision Partners' deliberate strategy to combine different but complementary market positions.

Characteristic | Fantastic Finishes | Chassis Master |

|---|---|---|

Business Age & Heritage | Modern operation founded by Russ Swift | 75-year-old, multi-generational family business |

Market Positioning | Premier collision-repair operation in the United States | Established luxury OEM and dealership repair provider |

Core Specialization | Ultra-luxury repair environments with uncompromising craftsmanship | Advanced structural and body repair, including framing and alignments |

Repair Capabilities | Complex, high-expectation collision restoration with disciplined processes | Complex collision restoration with manufacturer-approved technology and factory-certified equipment |

Customer Segments | OEM partners, dealerships, insurers, ultra-luxury vehicle owners | Luxury OEM partners, dealerships, structural repair customers |

Reputation & Differentiation | Culture of quality and accountability with longstanding customer trust | Decades of experience focused on vehicle integrity and "fixing it right the first time" |

Leadership Joining CP | Russ Swift (Founder) | Scott Woodard (41-year industry veteran) |

New Role at CP | Director of Strategic Operations | Vice President of Integrations |

Equity Partnership Status | Significant equity partner and long-term platform builder | Not disclosed |

Strategic Value to Platform | Quality-first culture, ultra-luxury capabilities, operational discipline | Structural repair expertise, 75-year legacy, deep OEM network |

Fantastic Finishes has earned longstanding trust from customers, OEM and dealership partners, and insurers alike through consistent execution across complex, high-expectation, ultra-luxury repair environments. The company's reputation in the Palm Beach market, where ultra-luxury vehicle repairs command premium pricing and require exceptional craftsmanship, provides Collision Partners with a quality benchmark for its platform.

Chassis Master brings different strengths. The company's longstanding reputation for advanced structural and body repair, including framing, alignments, and complex collision restoration, addresses the technical complexity side of the market. With manufacturer-approved technology, factory-certified equipment, and highly trained technicians focused on maintaining vehicle integrity, Chassis Master's 75-year operating history demonstrates the durability of a quality-focused business model.

Leadership Continuity as Competitive Advantage

A distinguishing feature of Collision Partners' approach is its emphasis on retaining founding operators as equity partners and platform leaders. Russ Swift, founder of Fantastic Finishes, joins Collision Partners as Director of Strategic Operations and as a significant equity partner, ensuring the quality culture he built remains embedded in the platform's DNA.

Similarly, Scott Woodard, a 41-year veteran of the collision-repair industry with extensive OEM and dealership relationships, joins Collision Partners as Vice President of Integrations. Woodard's four decades of industry experience and deep OEM connections provide critical infrastructure for onboarding future acquisitions while maintaining the certification and relationship requirements that drive profitability.

"When I met the CP team, I knew they were the right partners to preserve what makes this business special—our standards, our commitment to team, and our reputation," Swift said in a statement.

Woodard's endorsement carries particular weight given his industry tenure. "I've been in this industry for 41 years, and a lot of people have tried to build collision-repair platforms," he noted. "Collision Partners is different—they're doing it the right way."

The Private Equity Surge

Collision Partners enters a market experiencing unprecedented private equity interest. According to Focus Advisors, a boutique investment bank specializing in automotive aftermarket M&A, the firm spoke with more PE firms about collision repair in 2024 than ever before.

The appeal is clear: collision repair offers recession-resistant revenue streams, fragmented market structure enabling roll-up strategies, and increasing barriers to entry that favor scaled operators. The sector's defensive characteristics—people need their cars repaired regardless of economic conditions—combined with the capital intensity required for modern repair capabilities create a compelling investment thesis.

However, the collision repair industry has also witnessed consolidation failures. Several large multi-shop operators (MSOs) have struggled with integration challenges, quality control issues, and difficulty maintaining relationships with insurance carriers and OEM partners. The graveyard of failed collision repair roll-ups serves as a cautionary tale for new entrants.

Differentiation Through Quality

Collision Partners' "quality-first" positioning attempts to address the industry's historical consolidation challenges. Rather than competing primarily on volume or geographic coverage, the platform emphasizes operational excellence, technician retention, and preservation of local brand equity.

The company's stated mission—to "deliver the highest-quality repairs and to be the industry's most desired employer"—reflects recognition that technician shortage represents one of the collision repair industry's most significant constraints. Skilled collision repair technicians, particularly those certified for luxury OEM work, command premium compensation and have significant bargaining power in tight labor markets.

By retaining local brand names and empowering founding operators, Collision Partners aims to maintain the cultural elements that attract and retain top technician talent. This "Local at Scale" model, as the company describes it, attempts to capture consolidation benefits—purchasing power, shared services, capital access—while avoiding the cultural homogenization that can drive technician attrition.

Market Positioning and Growth Strategy

The Southeastern United States focus provides Collision Partners with several strategic advantages. The region's population growth, favorable business climate, and concentration of luxury vehicle ownership in markets like South Florida create attractive unit economics for quality-focused collision repair operations.

The company's emphasis on "diversified revenue channels, including luxury OEMs and dealerships, elite insurers, select fleets, and repeat customers" reflects sophisticated understanding of collision repair economics. OEM and dealership relationships typically generate higher revenue per repair order and better margins than insurance-driven work, though they require significant certification investments and quality consistency.

Collision Partners' selective acquisition criteria—"prioritizing businesses that share its commitment to quality, safety, and operational discipline"—suggests a measured growth approach rather than aggressive market share capture. This discipline may prove advantageous in a market where the collision repair industry's five largest consolidators pulled back on acquisitions in the first half of 2025.

Industry Headwinds and Opportunities

The collision repair sector faces several structural challenges that will test Collision Partners' model. Rising total loss rates—the percentage of damaged vehicles deemed uneconomical to repair—have compressed repair volumes for many operators. As vehicles become more expensive and repair costs increase, insurance carriers more frequently declare vehicles total losses rather than authorizing repairs.

Labor shortages persist across the industry. The collision repair workforce is aging, and technical schools have struggled to attract younger workers to the trade. This technician scarcity drives wage inflation and limits growth capacity for even well-capitalized operators.

However, these challenges also create opportunities for quality-focused platforms. As repair complexity increases, the gap widens between shops capable of handling advanced repairs and those limited to basic collision work. Shops with OEM certifications, ADAS calibration capabilities, and aluminum repair expertise can command premium pricing and maintain stronger margins.

The shift toward electric vehicles presents both opportunity and disruption. EV repairs require different expertise, equipment, and safety protocols. Platforms that invest early in EV repair capabilities may capture disproportionate market share as the vehicle fleet electrifies.

The Path Forward

Collision Partners' announcement indicates the company "continues to pursue additional partnerships selectively," suggesting an active acquisition pipeline. The platform's success will ultimately depend on execution: maintaining quality standards while scaling, integrating acquisitions effectively, and preserving the cultural elements that made target companies attractive in the first place.

The collision repair industry has seen numerous consolidation attempts over the past two decades, with mixed results. Large public consolidators like Caliber Collision and Service King have achieved significant scale but face ongoing challenges with margin pressure and integration complexity. Private equity-backed regional platforms have proliferated, though many struggle to differentiate beyond geographic presence.

Collision Partners' quality-first positioning and operator retention model offer a potentially differentiated approach, but the strategy's viability remains unproven at scale. The company's ability to maintain quality standards while growing, retain key personnel through equity partnerships, and generate returns sufficient to satisfy institutional capital providers will determine whether this latest entrant joins the ranks of successful consolidators or becomes another cautionary tale.

For independent collision repair shop owners, Collision Partners represents another option in an increasingly active M&A market. With more than 130 private equity firms expressing interest in the sector, quality operators have more exit options than ever before. The challenge lies in identifying partners who will preserve the business characteristics that created value in the first place—a promise Collision Partners makes explicitly but must prove through execution.