The private equity secondaries market is experiencing its finest hour, and Coller Capital just raised $17 billion to prove it.

The London-based firm announced today the final close of Coller International Partners IX (CIP IX), marking not only its largest fund ever but also positioning it as the world's largest dedicated private market secondaries manager with $50 billion in assets under management. The fundraise comes at a pivotal moment for secondaries—a once-niche corner of private markets that has vaulted into the mainstream as institutional investors scramble for liquidity and portfolio rebalancing tools.

"Secondaries are no longer seen as a tactical portfolio rebalancing tool but a core component of diversified portfolios," said Jeremy Coller, Chief Investment Officer and Managing Partner of Coller Capital, in a statement. "We are entering secondaries' finest hour."

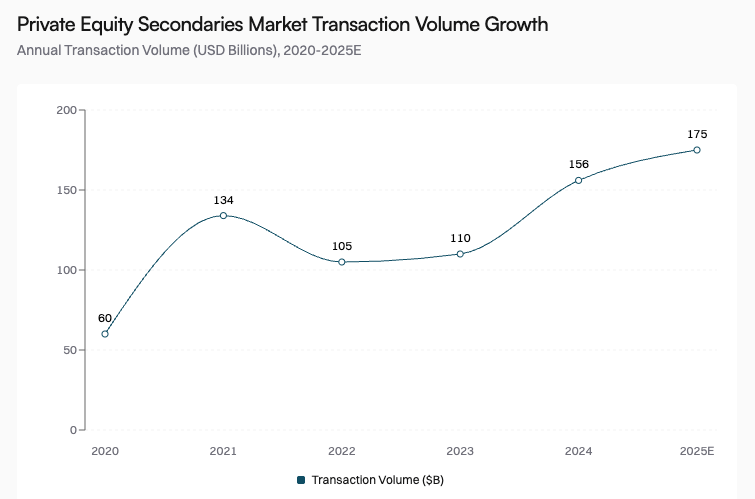

The numbers back up that bold claim. Private markets secondaries accelerated in the first half of 2025, with global transaction volume reaching $103 billion—a 51% increase from $68 billion in H1 2024, setting a new six-month record. The market has grown from $60 billion in 2020 to $156 billion in 2024, representing a remarkable 27% compound annual growth rate that shows no signs of slowing.

The Secondaries Boom: From Tactical Tool to Strategic Necessity

The explosive growth in secondaries reflects a fundamental shift in how institutional investors manage their private equity portfolios. What began as an emergency exit valve for distressed sellers has evolved into a sophisticated market offering diversification, faster deployment, and reduced J-curve risk.

Several factors are driving this transformation. Traditional exit routes remain constrained—IPO markets have been volatile, and strategic M&A activity has slowed amid economic uncertainty and elevated interest rates. Meanwhile, limited partners face mounting pressure to rebalance overallocated portfolios and generate liquidity for distributions and new commitments.

Enter secondaries. GP-led activity reached a first-half record, driven largely by multi-asset continuation vehicles, expanding 68% compared to 1H 2024. These continuation funds allow general partners to extend hold periods on their best-performing assets while providing liquidity to existing investors—a win-win that has become increasingly popular as traditional exit timelines stretch.

The secondaries market collected a whopping $165.88 billion through final closes last year, more than $53 billion larger than the previous record. That fundraising frenzy has created unprecedented dry powder, with managers racing to deploy capital into a market that can't seem to produce enough deal flow to satisfy demand.

Coller's Competitive Position: Scale Meets Specialization

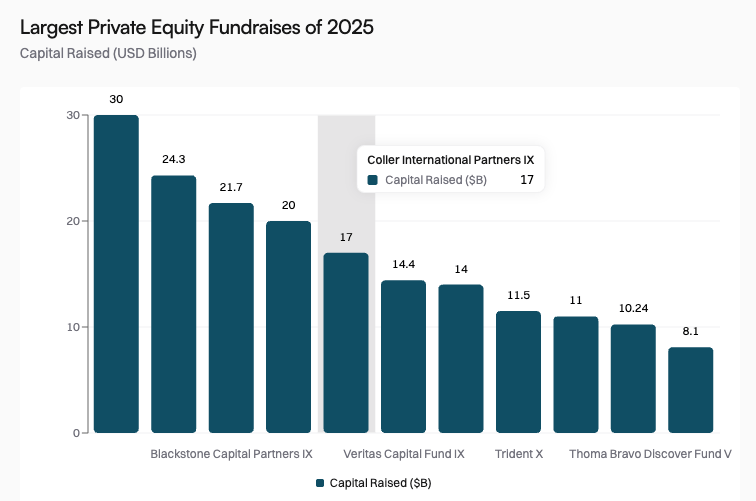

Coller's $17 billion raise places it firmly among the elite of private equity fundraising in 2025. The fund ranks as the fifth-largest PE fund closed during the year, trailing only Ardian's Secondary Fund IX ($30 billion), Thoma Bravo Fund XVI ($24.3 billion), Blackstone Capital Partners IX ($21.7 billion), and AlpInvest Secondaries Program VIII ($20 billion).

Among dedicated secondaries funds specifically, Coller is the third-largest, demonstrating the asset class's dominance in 2025's fundraising landscape. Secondaries funds captured three of the top five positions in the year's largest fundraises—a remarkable showing that underscores the structural shift toward secondaries as a core allocation rather than a tactical tool.

What distinguishes Coller from larger multi-strategy competitors like Blackstone and Thoma Bravo is its singular focus. With more than 35 years of experience exclusively in secondaries, the firm has built deep expertise in pricing complex portfolios, navigating intricate legal structures, and executing transactions that require specialized knowledge.

Metric | Value |

|---|---|

Fund Name | Coller International Partners IX (CIP IX) |

Capital Raised | $17B |

Total Firm AUM | $50B |

Number of Investors | 250+ |

Current Deployment Rate | Over 70% |

Investment Professionals | 77 |

Global Offices | 11 |

Track Record | 35+ years |

Market Position | World's largest dedicated private markets secondaries manager |

That specialization translates into operational scale. Coller maintains 77 investment professionals across 11 offices globally, giving it the reach to source deals in every major market and the bandwidth to execute some of the largest and most complex transactions in the industry. The firm's investor base reflects this institutional credibility: over 250 investors around the world, including leading pension funds, insurance companies, sovereign wealth funds, asset managers, and financial institutions.

Rapid Deployment Signals Strong Deal Flow

Perhaps the most telling metric in Coller's announcement is deployment velocity. CIP IX is already over 70% deployed, an impressive figure for a fund that just held its final close. In secondaries, rapid deployment indicates two critical factors: robust deal flow and competitive positioning to win attractive transactions.

The speed of deployment also reflects the current market dynamics. With traditional exits constrained and limited partners seeking liquidity, secondaries transactions have become a primary mechanism for portfolio management. Sellers are more willing to transact, bid-ask spreads have narrowed, and dedicated secondaries capital has reached record levels—creating ideal conditions for deployment.

Coller's strategy targets both LP-led and GP-led secondary transactions around the globe, focusing on high-quality portfolios that offer diversified exposure to private equity assets. This dual approach provides flexibility to capitalize on opportunities across the secondaries spectrum, from traditional LP portfolio sales to structured continuation funds and single-asset deals.

The Structural Drivers Behind Secondaries Growth

The secondaries market's ascent from niche to mainstream reflects several structural trends that appear durable rather than cyclical.

Denominator Effect Pressures: Many institutional investors find themselves overallocated to private equity as public market valuations have compressed while private holdings have remained marked at higher levels. Secondaries offer a mechanism to rebalance without waiting for fund distributions.

Extended Hold Periods: The average holding period for private equity investments has stretched from 4-5 years historically to 6-7 years today. As funds approach the end of their investment periods with unrealized portfolios, continuation funds provide an alternative to forced sales at inopportune times.

Liquidity Constraints: With distributions from private equity funds running below historical norms, limited partners face cash flow challenges that make secondaries an attractive source of liquidity. LPs sought solutions for portfolio management and liquidity amid capital constraints and slower-than-expected distributions.

Professionalization of the Market: The secondaries market has matured significantly, with standardized processes, sophisticated pricing models, and experienced intermediaries facilitating transactions. This professionalization has reduced friction and attracted more participants.

Expansion Beyond Traditional Secondaries

While CIP IX focuses on traditional private equity secondaries, Coller has expanded its platform to capture adjacent opportunities. The firm now offers dedicated credit secondaries funds, equity and credit perpetual funds for the wealth market, and insurance and structured product solutions.

This diversification reflects the broadening of secondaries beyond buyout funds. Private debt followed closely behind infrastructure as a share of both GP-led and LP-led deals in 2024, and venture secondaries are also expanding rapidly. As private markets have grown across asset classes, secondaries have followed, creating new opportunities for specialized managers.

The wealth market represents a particularly intriguing frontier. As private equity access expands to high-net-worth individuals through perpetual fund structures, secondaries solutions for this segment could unlock significant growth. Coller's early positioning in this space could provide a competitive advantage as the market develops.

Market Outlook: Tailwinds Remain Strong

Looking ahead, the conditions that have fueled secondaries growth appear likely to persist. The market is projected to reach $175 billion in 2025, continuing its upward trajectory. Several factors support this optimism.

First, the overhang of unrealized private equity assets remains substantial. With exit activity below historical levels and fund vintages from 2020-2022 approaching maturity, the pipeline of potential secondaries transactions is robust.

Second, the denominator effect is unlikely to resolve quickly. Even if public markets recover, the sheer scale of private equity commitments made in recent years means many institutions will remain overallocated for years to come.

Third, GP-led transactions have proven their value proposition. As general partners recognize the benefits of continuation funds—extended hold periods for winners, liquidity for existing LPs, and additional fee streams—these structures are likely to become a standard tool rather than an exception.

Finally, the capital raised by secondaries funds creates its own momentum. With record dry powder seeking deployment, competition for assets will remain intense, potentially supporting pricing and encouraging more sellers to come to market.

Risks and Considerations

Despite the bullish outlook, secondaries investors face several challenges. Pricing remains a critical concern—as competition intensifies and bid-ask spreads narrow, the margin for error shrinks. Secondaries funds must maintain pricing discipline to generate attractive returns, particularly as they deploy capital at scale.

Valuation transparency is another consideration. While the secondaries market has become more sophisticated, pricing complex portfolios still requires significant judgment. As funds deploy capital rapidly in a competitive environment, the risk of overpaying increases.

The concentration of capital in a few large managers also raises questions about market dynamics. With Ardian, Blackstone, AlpInvest, and Coller collectively managing well over $100 billion in secondaries capital, these firms wield significant influence over pricing and market structure.

Conclusion: Secondaries Come of Age

Coller Capital's $17 billion fundraise represents more than a successful capital raise—it marks the coming of age of private equity secondaries as a core asset class. What began as a niche market for distressed sellers has evolved into a sophisticated ecosystem offering liquidity, diversification, and portfolio management solutions to institutional investors worldwide.

With 35 years of experience, $50 billion in assets under management, and a global platform spanning 11 offices, Coller has positioned itself at the center of this transformation. As Jeremy Coller noted, secondaries are entering their "finest hour"—and his firm has raised the capital to capitalize on it.

For limited partners navigating an uncertain exit environment, elevated interest rates, and portfolio rebalancing pressures, secondaries offer a valuable tool. For general partners seeking to extend hold periods on their best assets while providing liquidity to investors, continuation funds have become essential. And for dedicated secondaries managers like Coller, the convergence of these trends has created a once-in-a-generation opportunity.

The question now is not whether secondaries will continue to grow—the structural drivers appear too strong to reverse—but rather how the market will evolve as it matures. With record capital raised, intense competition for assets, and expanding applications across private credit, venture, and infrastructure, the secondaries market of 2030 may look quite different from today.

What seems certain is that Coller Capital, with its $17 billion war chest and decades of specialized expertise, will play a central role in shaping that future.