The commercial roofing industry's consolidation wave gained fresh momentum this week as Angeles Equity Partners' portfolio company O'Hara's Son Roofing announced its acquisition of CP Rankin Inc., marking the platform's third add-on transaction in just eight months. The deal underscores the accelerating pace of private equity-led roll-ups in the highly fragmented home services sector, where thousands of regional operators present ripe consolidation opportunities for well-capitalized buyers.

Founded in 2001 and headquartered in Chalfont, Pennsylvania, CP Rankin is a full-service commercial roofing contractor offering re-roofing, new construction, and repair and maintenance services with operations across seven locations along the East Coast and Southeast. The acquisition significantly expands O'Hara's Son Roofing's geographic footprint across the Eastern United States, adding critical density in the New England, Northeast, Mid-Atlantic, and Southeast regions.

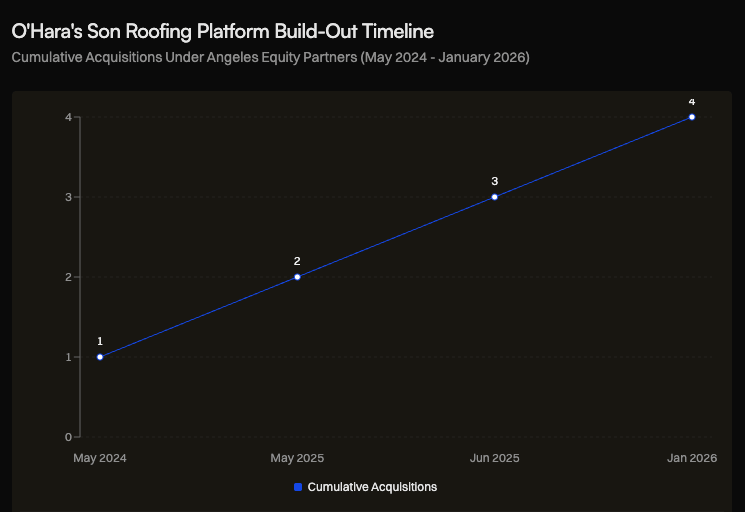

The transaction, announced January 13, represents a textbook example of the buy-and-build strategy that has become increasingly prevalent in commercial services sectors. For Angeles Equity Partners, a Los Angeles-based firm specializing in operational transformation of niche industrial businesses, the deal continues an aggressive platform build-out that began with the acquisition of O'Hara's Son Roofing in May 2024.

The Platform Build-Out Strategy

Since establishing O'Hara's Son Roofing as a platform investment in May 2024, Angeles has executed a disciplined acquisition strategy focused on geographic expansion and service capability enhancement. The Chicago-based platform company already operated regional service centers in Florida, New Jersey, and Texas at the time of the initial acquisition, providing a foundation for national expansion.

The add-on acquisition pace has been notably aggressive. Following the platform purchase, Angeles completed acquisitions of Starkweather Roofing in May 2025 and Total Systems Roofing in June 2025, before adding CP Rankin in January 2026. This represents four total transactions in just 18 months—a cadence that signals both ample available capital and a fragmented market ripe for consolidation.

"CP Rankin has built a highly respected business defined by operational excellence, an extensive self-perform services offering, and strong customer relationships," said Luke Coleman, CEO of O'Hara's Son Roofing, in a statement. "We are thrilled to welcome the CPR team to the OSR platform and are confident this partnership will significantly expand our ability to serve customers across the New England, Northeast, Mid-Atlantic, and Southeast regions."

The strategic rationale is clear: by assembling a national platform of regional commercial roofing providers, Angeles aims to capture economies of scale in procurement, back-office operations, and customer service while maintaining the local market expertise and customer relationships that drive success in the services sector.

A Fragmented Market Beckons Consolidators

The commercial roofing industry presents an attractive target for private equity consolidation strategies. The sector is characterized by thousands of small, family-owned operators serving local and regional markets, with few players achieving true national scale. This fragmentation creates inefficiencies that well-capitalized consolidators can exploit through operational improvements, purchasing power, and technology investments.

Market dynamics support the consolidation thesis. The US roofing market is estimated at $24.79 billion in 2025 and is expected to reach $33.44 billion by 2030, representing a 6.17% compound annual growth rate. The broader US roofing contractors industry reached $99.8 billion in 2025 with 6.0% CAGR over the past five years, reflecting the labor-intensive nature of roofing services and the significant value-add from installation, maintenance, and repair services beyond materials alone.

Metric | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | CAGR |

|---|---|---|---|---|---|---|---|---|

US Roofing Market (Total) | $23.35B | $24.79B | $26.32B | $27.94B | $29.67B | $31.50B | $33.44B | 6.17% |

US Roofing Contractors Industry | $94.15B | $99.80B | $105.79B | $112.14B | $118.86B | $126.00B | $133.55B | 6.0% |

Residential Roofing Segment | $11.29B | $11.80B | $12.33B | $12.88B | $13.46B | $14.07B | $14.70B | 4.5% |

Commercial Roofing Segment | $12.06B | $12.99B | $13.99B | $15.06B | $16.21B | $17.43B | $18.74B | 7.7% |

Particularly noteworthy is the strength in the commercial segment, which demonstrates stronger growth momentum than residential roofing. Industry survey data reveals that 66% of commercial roofing contractors reported increased sales volume growth from 2024 to 2025, validating the strategic focus on commercial applications.

The Angeles Equity Playbook

Angeles Equity Partners has carved out a niche focusing on what it describes as "operational transformation and strategic repositioning" of businesses in niche manufacturing, critical industrial services, and specialty distribution. The firm's approach emphasizes value creation through operational improvements rather than financial engineering—a strategy well-suited to fragmented services sectors where professionalization and scale can drive significant margin expansion.

The O'Hara's Son Roofing platform exemplifies this approach. Rather than simply aggregating revenue, the strategy appears focused on building a genuinely integrated national platform capable of serving both regional and national clients. This dual capability is increasingly valuable as large property owners and facility managers seek to consolidate their vendor relationships with providers who can deliver consistent service quality across multiple markets.

"OSR presented a compelling opportunity in a highly fragmented industry to acquire one of the largest providers of commercial roofing services participating in all phases of the roofing life cycle," said Sam Heischuber, managing director at Angeles Equity Partners, when the initial platform acquisition was announced.

The firm has retained Luke Coleman as CEO, a common private equity practice that preserves operational continuity and industry expertise while providing capital and strategic support for accelerated growth.

CP Rankin: A Strategic Fit

For CP Rankin, the transaction represents a liquidity event after 25 years of building a strong services business and trusted customer relationships across the Eastern Seaboard, according to founder Craig Rankin. The company's seven-location footprint along the East Coast and Southeast provides O'Hara's Son Roofing with immediate market presence in regions where the platform previously lacked density.

Critically, CP Rankin brings more than just geographic coverage. The company has built a reputation for high-quality execution and responsive service while serving a diverse customer base that includes property managers, general contractors, and national retail and commercial customers. This customer diversity reduces concentration risk and provides cross-selling opportunities as the platform scales.

The company offers a full suite of commercial roofing services including re-roofing, new construction, and repair and maintenance—capabilities that align with O'Hara's Son Roofing's strategy of participating in all phases of the roofing lifecycle. This comprehensive service offering is particularly valuable in commercial applications, where building owners increasingly prefer single-source providers who can handle everything from emergency repairs to complete roof replacements.

Following the transaction, CP Rankin will continue to operate under its existing name, preserving its brand identity, leadership, and commitment to customer service. This approach—maintaining acquired companies' brands and local management teams—has become standard practice in services sector roll-ups, where local relationships and reputation drive customer retention.

The Broader Home Services Consolidation Wave

The O'Hara's Son Roofing build-out is part of a broader consolidation trend sweeping across home and commercial services sectors. From HVAC and plumbing to electrical and roofing, private equity firms have identified fragmented services markets as attractive targets for buy-and-build strategies.

Several factors drive this trend. First, demographic shifts are creating succession challenges for family-owned businesses, with many founders reaching retirement age without clear succession plans. Private equity provides a liquidity option while often retaining existing management and employees.

Second, technology is creating opportunities for operational improvement that smaller operators struggle to capture independently. Consolidated platforms can invest in customer relationship management systems, routing optimization, inventory management, and digital marketing capabilities that drive efficiency and growth.

Third, large commercial customers increasingly prefer working with national or multi-regional providers who can deliver consistent service quality across their property portfolios. This trend favors scaled platforms over local operators, creating a competitive imperative for consolidation.

The roofing sector specifically benefits from recurring revenue characteristics, as commercial roofs require regular maintenance and eventual replacement on predictable cycles. This visibility into future revenue streams makes roofing platforms particularly attractive to financial buyers.

Deal Structure and Advisors

While financial terms of the CP Rankin acquisition were not disclosed, the transaction structure appears consistent with typical add-on acquisitions in the services sector. Such deals typically involve a combination of upfront cash consideration and potential earnouts tied to performance metrics, allowing sellers to participate in future value creation while ensuring alignment during the integration period.

Massumi + Consoli LLP served as legal counsel to O'Hara's Son Roofing, while Fox Rothschild LLP advised CP Rankin. The involvement of established M&A counsel on both sides suggests a professionally negotiated transaction with appropriate protections for both parties.

Looking Ahead: The Path to Exit

For Angeles Equity Partners, the aggressive acquisition pace raises questions about the ultimate exit strategy. Private equity firms typically target holding periods of four to seven years, suggesting Angeles may be positioning O'Hara's Son Roofing for a sale to a larger strategic buyer or a secondary buyout by a larger private equity firm within the next few years.

The platform's growing scale and geographic diversity should make it increasingly attractive to potential acquirers. Strategic buyers in adjacent sectors—such as building materials distributors or diversified facility services companies—might see value in vertical integration or service expansion. Alternatively, larger private equity firms with more capital could view the platform as a foundation for even more aggressive consolidation.

The commercial roofing market's favorable growth dynamics, recurring revenue characteristics, and continued fragmentation suggest ample runway for further expansion. With thousands of potential acquisition targets still operating independently across the United States, O'Hara's Son Roofing's buy-and-build strategy appears far from complete.

As the platform continues to scale, the key challenge will be maintaining service quality and customer relationships while integrating multiple acquisitions and standardizing operations. Success in services sector roll-ups ultimately depends on execution—the ability to realize promised synergies while preserving the local expertise and customer focus that made acquired companies valuable in the first place.

For now, the CP Rankin acquisition demonstrates that Angeles Equity Partners remains committed to aggressive growth, with the capital and conviction to continue consolidating a fragmented market. Whether this strategy ultimately delivers the returns private equity investors expect will depend on the firm's ability to build not just a larger company, but a genuinely better one.